NEBRASKA LEGISLATURE

The official site of the Nebraska Unicameral Legislature

Sen. Steve Erdman

District 47

The content of these pages is developed and maintained by, and is the sole responsibility of, the individual senator's office and may not reflect the views of the Nebraska Legislature. Questions and comments about the content should be directed to the senator's office at serdman@leg.ne.gov

August 23rd, 2019

As the old saying goes, “When it rains, it pours!” And so has it been in the Nebraska Panhandle. Whether it be the Spring Blizzards, the irrigation tunnel collapse, or the recent hail storms, western Nebraska has been absolutely pummeled this year with precipitation and severe weather. Fortunately, some relief is now on the way.

Last week I toured the site of the Gering to Ft. Laramie-Goshen irrigation tunnel collapse with a representative from U.S. Senator, Ben Sasse’s office, Nebraska Secretary of State, Bob Evnen, and Assistant Secretary of State, Cindi Allen. After assessing the damage and seeing the loss of water to some 54,000 acres in western Nebraska, there was no question that something had to be done on the federal level.

So, last Thursday, Sen. Ben Sasse, Sen. Deb Fischer, and Congressman Adrian Smith, of Nebraska along with Wyoming Senators Mike Enzi, John Barrasso, and Congresswoman Liz Cheney wrote to the U.S. Secretary of Agriculture, Sonny Perdue, asking him for crop insurance protection. Their letter to the U.S. Secretary of Agriculture is what did the job.

The U.S. Secretary of Agriculture responded the very next day. On Friday the U.S. Secretary of Agriculture, Sonny Perdue, announced that the Gering to Fort Laramie-Goshen irrigation tunnel collapse was caused by unusually high precipitation in the area. Consequently, the Risk Management Agency determined that since the tunnel collapse was due to natural causes, crop insurance would cover all those agricultural producers affected by the disruption in the water supply. This is great news for farmers and ranchers in the affected area.

Western Nebraska has been hit very hard this year, and there remains still more work to be done. However, please know that your elected officials are all working hard to give you the relief you need. The last thing we need in western Nebraska is a string of more farmers and ranchers filing for bankruptcy.

So, today I want to express my gratitude to U.S. Sen. Ben Sasse, U.S. Sen. Deb Fischer, and Congressman Adrian Smith as well as those politicians named above from Wyoming for doing the right thing and writing that letter. Because they advocated for farmers and ranchers in western Nebraska and eastern Wyoming who’ve been affected by this natural disaster, we should all be grateful. Most of all, though, I thank God for his providential care and for extending to us his generous hand of provision during this time of great need.

July 19th, 2019

This week I want to bring to your attention a matter of great concern to everyone living in Western Nebraska. In case you haven’t heard, an irrigation tunnel in Eastern Wyoming recently collapsed, which carries water to 104,000 acres of agricultural land.

This canal originates in Eastern Wyoming and irrigates approximately 50,000 acres in that state. As the irrigation waters cross the border into the Panhandle of Nebraska, it waters another 50,000 acres in Scotts Bluff County alone.

The irrigation tunnel that collapsed runs through a large hill in Eastern Wyoming. The collapsing of the tunnel created a sinkhole on the hill that is 100 feet across and 50 feet deep. The top of the tunnel is still more than 100 feet below the bottom of this sinkhole.

Governor Ricketts, the Nebraska Department of Natural Resources, the Nebraska Director of Agriculture and me are involved in talks with the management of the irrigation canal to see how we might help the situation. We will assist in any way we can.

We have been in contact with the Governor of Wyoming, State Legislators in Wyoming, and others who may be able to help resolve this problem. The tunnel collapse is a huge economic catastrophe for farmers in Eastern Wyoming and Western Nebraska. This catastrophe will affect the economies of both states.

Unless irrigation waters can be restored to these regions in a timely manner, crops will die. This could mean the loss of hundreds of millions of dollars in agricultural revenues in our state. Even if we were to fix the problem in a couple of weeks, it could still result in significant losses in yields for those crops that are in dire need of irrigation waters during these hot summer days in the middle of July.

This disaster will likely effect more agricultural acres than the flooding that occurred in Easter Nebraska earlier this spring. Some may be tempted to think that this issue is isolated to those farmers living in Scotts Bluff County or Western Nebraska, but its effects will be felt all across the state.

I cannot emphasize enough how serious this disaster is for everyone involved. This could likely force some agricultural producers and families in Western Nebraska, as well as some businesses that deal directly with agriculture, to face the threat of bankruptcy. When crops are threatened, it puts an undue strain on the spouses and children of farming families, as well as others, such as landlords, who are associated with the agricultural industry of our state. Ultimately, all Nebraskans will feel the effects of this disaster because agriculture is the engine that drives our State’s economy.

Just as Nebraskans pulled together during the spring to help with those victims of the floods we also need to ban together to help those affected by this issue as well. So as you ask the question, “How can I help?” The answer is to pray. Pray for those making the decisions about repairing the irrigation canal, and pray for those affected by the lack of irrigation water.

While most farmers have crop insurance, they will likely only recover the cost of what they have already put into the ground. Crop insurance usually doesn’t cover the yield. So, there will be no revenue left to pay property taxes, mortgages, and other living expenses associated with an agricultural operation.

I will keep you informed as we go through the process of resolving this issue. Thank you for caring for our agricultural families and thank you for praying. May God save our crops, and may God bless Western Nebraska.

July 5th, 2019

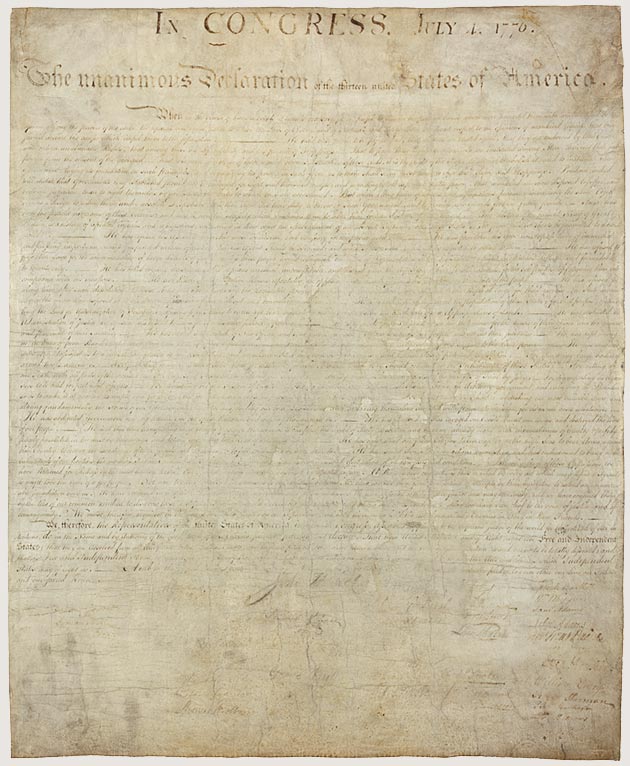

When in the course of legislative events it becomes apparent that legislators place undue burdens of taxation upon the people, it becomes incumbent upon the people of a free and democratic society to take matters into their own hands and to assert their own will over the legislative process. When powerful legislators turn a deaf ear to the plight of the landowner, it becomes time for the common people of the state to act. When taxation with unfair representation becomes so burdensome that a man or a woman cannot earn a living for himself or herself, but becomes a slave to the State, a new revolution begins knocking on our door. And, today I am opening that door.

Fortunately for us, such a revolution does not have to involve the taking up of arms or involve the shedding of blood. The forefathers of our great State were very wise men, who foresaw the coming of this fateful day. So, in 1912 they gave us a very valuable tool for revolution. Our forefathers provided the common people of Nebraska with a means for asserting their will over the legislative process, and that tool is called the “ballot initiative.” Through the process of a successful petition drive, the common people of our State possess the power to assert their will over a blind, uncaring and dull Legislature.

For many property owners living in Western Nebraska property taxes have spun out of control and have become a burden too heavy to bare. Some today are even selling their farms and ranches and are moving to other states in order to labor where the burden of taxation is more affordable. But, farms and ranches are the staples of Western Nebraska as well as the engine which drives our State’s economy. Without farms and ranches, Nebraska would turn into a vast wasteland.

When landowners suffer, so does the State’s economy. The voices of the property owners continue to fall on deaf ears inside the State Capitol precisely because the State does not feel the pain of the average property owner. As long as that pain remains unnoticed and unfelt in Lincoln, State Senators will continue to turn a blind eye to the problem of over-taxation.

The State Legislature will never pass any kind of meaningful legislation for property tax relief until they are forced to do so. The language of our ballot initiative is exactly what is needed to force the Legislature to act. The reason our petition drive will force the Legislature to act is because the language of the ballot measure amends the State Constitution. Without a constitutional amendment, the Legislature would have the power to reverse or overrule the will of the people, and that is exactly what they would do if given the chance. However, with a constitutional amendment firmly set in place, State Senators would finally find themselves roped and tied to do the will of the people.

Nebraska is one of only 21 states which allow for a ballot initiative. So, we are fortunate to have this means at our disposal. But, unless we use it to overcome the will of a deadlocked Legislature, we will only get the pain and suffering we deserve. Therefore, today I am asking all Nebraskans to support our petition drive for property tax relief. Our ballot initiative would provide every Nebraska property owner the opportunity to claim a 35 percent credit or refund of their property tax bill on their State Income Tax Return. If you would like to know more about the ballot initiative or how to become part of this revolution for property tax relief, then please visit www.truenebraskans.com.

June 28th, 2019

This week we celebrate our nation’s independence from Great Britain. As Americans we love liberty and despise tyranny. Liberty is so foundational to our American form of government that Thomas Jefferson included it as one of our unalienable rights in the Declaration of Independence. But, what led Jefferson to declare liberty as a God-given right? With some help from my staff, this is what I discovered.

The Founding Fathers were greatly influenced by the political philosophy of John Locke. In 1689 Locke published his Second Treatise on Government, which outlined his ideas for a more civilized form of government. Human rights and religious liberty were especially important to Locke because he had to escape England due to his own religious beliefs. Locke believed the primary purpose of government was to secure liberty. But, Locke also understood that liberty could not be devoid of morality, so, he wrote about civil government that, “…though this be a state of liberty, yet it is not a state of license.” Little did Locke know that his ideas would inspire an American Revolution in less than 100 years.

Revolution had been stirring in the American colonies at least since the days of the Boston Massacre in 1770. In 1773 Samuel Adams led a band of men to raid a British merchant ship, dumping its cargo of tea into the harbor. This led the British to impose the Intolerable Acts on the Colonies and to put a naval blockade on Boston Harbor. By the summer of 1774 most of the colonists had finally had enough of British tyranny. So, in September 1774 delegates from 12 of the 13 colonies met in Carpenters’ Hall in Philadelphia to conduct the First Continental Congress.

The next year tensions began escalating towards war as Great Britain began amassing military forces in Virginia. So, on March 23, 1775 120 delegates convened in St. John’s Church in Richmond to conduct the Second Virginia Convention. Among the delegates in attendance were George Washington, Thomas Jefferson and five other men who would later sign the Declaration of Independence. With “an unearthly fire burning in his eye,” according to one Baptist minister, Patrick Henry took to the podium and began to speak without using notes. Near the end of his speech Henry declared, “The war is actually begun.” And after a few more words Henry ended his speech with the words that would later make him famous, “I know not what course others may take; but as for me, give me liberty or give me death!”

On June 11, 1776 the Continental Congress appointed a Committee of Five to draft the Declaration of Independence. Those on the committee were: Thomas Jefferson, John Adams, Benjamin Franklin, Robert Livingston, and Roger Sherman. Adams and Sherman had earlier declared that the rights of conscience were sacred. But, during the days of the writing of the Declaration of Independence the subject of liberty took center stage again. The debate was whether or not a secular state could uphold liberty apart from God and morality. So, on June 21, 1776 John Adams wrote these words:

“Statesmen…may plan and speculate for liberty, but it is Religion and Morality alone, which can establish the Principles upon which Freedom can securely stand. The only foundation of a free Constitution is pure Virtue, and if this cannot be inspired into our People in a greater Measure, than they have it now, they may change their Rulers and the forms of Government, but they will not obtain a lasting liberty.”

Concluding that liberty was inseparable from God and morality, Thomas Jefferson along with the Committee of Five took the concept of liberty to the next level, carrying it out to its logical conclusion. Liberty, they decided, is a basic human right which comes from God. So, Jefferson wrote, “We hold these truths to be self-evident, that all men are created equal, that they are endowed by their Creator with certain unalienable Rights, that among these are Life, Liberty, and the pursuit of Happiness.”

June 21st, 2019

People enter into politics for a variety of different reasons, and those reasons end up defining that Senator’s personal political philosophy. For instance, some come into the Legislature with a single focus, such as to improve education or healthcare. Others come to do the bidding of the lobbyists. Still others come to impose their worldview on society. To the contrary, I believe the primary duty of a State Senator should be to act on the best interest of the people of the State.

For this reason, I have tried to focus my attention on what I believe Nebraskans need most. What I hear from people all across the State of Nebraska is that they need property tax relief and agricultural land valuation reform most. For this reason, I have made these two issues my highest priorities as a State Legislator. As a result, this year many with destroyed property from the blizzards and floods will get property tax relief because I was able to successfully pass a bill with a provision for property tax relief for those with destroyed property.

What I like most about being a Nebraska State Senator, though, is actually helping people. Besides writing bills, serving on the Appropriations Committee, and speaking on the floor of the Legislature, being a Nebraska State Senator allows me to serve Nebraskans in some very unique ways. When I am not fretting over the state budget, property tax relief and agricultural land valuation reform, I often find myself helping people solve difficult problems and improving their situation in life.

Government often fails people. Because I see how government fails people, I try to resolve those situations where people get left behind or fall through the cracks. Working behind the scenes this year, I have been able to help many of our constituents in Legislative District 47. For instance, I once helped a truck driver obtain a birth certificate from a department that was backlogged due to a reduction in personnel. He needed the birth certificate in order to renew his commercial driver’s license. We were able help him get the birth certificate in time so that he did not lose a single day of driving. I have been able to help many other constituents with similar kinds of problems.

This philosophy of helping people when government fails sometimes takes me across the state. I have even been able to help some who live as far away as Omaha’s inner city. For instance, I recently helped a young, single, kinsman foster mom living in Omaha’s Southside get her foster child back. Child Protective Services had taken her child away because Omaha Public Power District had turned her power off. She couldn’t pay her electric bill because DHHS was sending her check to the wrong person! Once we got that straightened out, she was able to pay her electric bill, get her power restored, and get her foster child back.

So, if government seems to be failing you or is just leaving you in the dust, please know that I want to help. So, please don’t hesitate to call my office at (402) 471-2616. Not every situation can be resolved, but when government is the problem, I will do my best to fix it. Thank you for giving me this opportunity to serve the people of Nebraska.

June 14th, 2019

On June 11 President Trump delivered a speech in Council Bluffs, Iowa, where he lifted the ban on E15 gasoline for the summer months. E15 is gasoline mixed with 15 percent ethanol. The announcement was good news for Nebraska farmers, because Iowa and Nebraska are the top two ethanol producing states in the country. So, the more ethanol we sell, the better it is for Nebraska’s corn growers.

E15 has been the subject of much criticism in recent years. So, today I would like to explain why E15 is a great Nebraska product and why we need it for the future. Whether we want to admit it or not, E15 is here to stay, but there are some very good reasons why we should all like this unique Nebraska product.

The first reason that makes E15 such a great product is that it helps the United States compete in the global oil market. Because of political turmoil in places such as the Middle East and Venezuela, the United States can no longer depend upon these oil producing countries to supply us with the oil we need. As President Trump said in his speech, “More American ethanol production means less dependence on foreign supplies.” The United States needs to become an oil independent nation, and American ethanol plays an important role in helping us reach that goal. Some, such as the Union of Concerned Scientists, believe ethanol has the potential to cut our use of gasoline in half.

A second reason why E15 is a great product is because it is harmless to your vehicle. One of the main criticisms of ethanol in the past has been that it is harmful to your engine’s fuel system, but these criticisms have been largely debunked by objective studies. For instance, one such objective study was conducted by the National Renewable Energy Laboratory in March 2012. That study found no remarkable degradation in fuel systems in cars with models dating back as far as 1995. As a general rule, though, you should not use E15 in classic cars, cars manufactured prior to 2001, or in small engines, such as your lawn mower.

A third reason that makes E15 such a great product is that the timing is right. E15 is a fuel for America’s future. The EPA has approved E15 for all cars manufactured since 2001, but this year car manufacturers are rolling out new models specifically designed for burning E15. The only holdouts this year are BMW, Lamborghini, Mercedes-Benz, Mitsubishi, Mazda, and Volvo. I believe these foreign car manufacturers will come around soon, especially once they learn that Americans want to buy new cars that are even better designed for burning E15.

Nebraska stands to benefit greatly from this increased demand for E15 and other ethanol products. President Trump also signed an executive order on June 11 to promote agricultural biotechnology. The executive order will direct federal agencies to streamline regulations and to speed up innovation. Consequently, the new E15 rule change along with biotechnology and higher demands for the product will only spur on development and encourage economic growth in our state. So, in the final analysis E15 is very good for Nebraska.

June 7th, 2019

Friday, June 14th is Flag Day. So, today I want to encourage you to fly your American flag with pride. The United States of America is the greatest nation in all of world history. No other nation has ever come close to matching the greatness of our republic, and today I want to remind you of that fact.

Some may ask, “Has America always done what is right?” The answer to this question is most assuredly, “No”. Such things as slavery, racism, and Native American genocide will forever tarnish our nation’s past. To be sure, it would be foolish to say that America has always been on the right side of truth, justice, liberty and righteousness.

No nation governed by human beings will ever be so perfect. The reason is that human beings are fallible. We make mistakes. As human beings, Americans are neither superhuman nor divine. However, what distinguishes America from the other nations of the world is the fact that we can talk openly about our past and learn from our mistakes. The fact that we recognize in the First Amendment to the U.S. Constitution that freedom of religion, freedom of speech, freedom of the press, freedom of assembly, and freedom to petition the government as basic human rights is exactly what makes our republican form of government so great.

Despite our checkered past, America truly has a great story to tell. America, more than any other nation, has been the worldwide defender of freedom. When dictators arise and oppress nations, those nations turn to the United States of America for deliverance. On June 6th we celebrated the 75th Anniversary of the Normandy Invasion. Had the United States of America not intervened in Europe during WWII, Europeans would still be oppressed by Nazi dictators today.

Besides being the worldwide champions of justice and liberty, the American people have excelled more than any other modern nation in science, technology, philosophy, education, art, sports and entertainment. The list of American accomplishments is far too numerous to list exhaustively here. But, despite all of our wonderful achievements there remains still one more aspect of our American nation which propels us to the top of the list of the world’s greatest societies.

So what is it that makes America so great? The ultimate source of American greatness is the fact that we have always looked to God, honored him, and credited him for our success. Throughout our history as a nation, Americans have always recognized and honored God as the true source of our providential blessing. Perhaps, our National Motto says it best: “In God We Trust” or the song we sing at every baseball game, “God Bless America.” So, this year when you pledge your allegiance to the flag of the United States of America, remember what it means to be “One nation under God.”

Even when the future of America seems bleak, the American spirit remains strong. As Americans, we view every potential disaster as an opportunity to put American greatness on display for the rest of the world to see and to marvel at, and all of our American greatness is summed up and represented through the stars and stripes on the American flag.

So, as we fly our American flags high on Friday, let us remember all of these things which make America great, and let us teach them to our children, so that the next generation of Americans can be even greater than ours.

May 31st, 2019

The first session of the 106th Legislature has now come to an end. Just like students who receive their report cards at the end of the school year, so also should the Nebraska State Legislature be graded. So, what kind of grade should be given to the Nebraska State Legislature this year? In my assessment, the Legislature has earned a grade of D along with the comment, “Needs Much Improvement.”

So, why do I give the Nebraska State Legislature such a poor grade? I have given the Legislature a low grade because of what they failed to do this year. Most importantly, the Legislature failed to pass legislation for significant property tax relief, including LR3CA, my Resolution to put a measure on the 2020 ballot for a Constitutional Amendment for property tax relief. Moreover, LB 289 also failed in the Legislature. This bill would have given Nebraska property owners significant property tax relief for 2018 but made up for the loss in revenue by eliminating numerous sales tax exemptions, such as pet grooming services, tattoo services, and wedding planning services.

The second reason why the Nebraska State Legislature deserves such a poor grade is because they failed to reform the way we value agricultural land for property tax purposes. Nebraska needs to switch to an income based approach to valuing agricultural land, instead of using the current market approach. Although my priority bill, LB 483, advanced out of the Revenue Committee this year, it failed to advance beyond General File. Instead, the Legislature passed my other bill, LB 372, which forces the Property Assessment Division to use appropriate indexes when valuing agricultural land for property tax purposes in the current market based system. While this bill will slightly improve the current market based system, it won’t solve the major problems associated with using this method.

The third reason why the Nebraska State Legislature deserves such a poor grade is because they failed to cut spending. Contrary to the opinion of the Governor as wells as certain other Senators who serve on the Appropriations Committee, a smaller increase in spending does not constitute a cut in spending. The Legislature increased overall spending this year by 2.9 percent. If you managed your budget the same way that the State does theirs, you would soon go bankrupt, and that is what is slowly happening to the State.

What saves me from rating the Nebraska State Legislature with a failing grade is the fact that a few good bills actually did pass this year. One such bill was LB 244. LB 244 was my bill to make an allowance for massage therapists to make use of mobile units in the practice of their business. Because LB 244 passed along with an emergency clause and was signed by the Governor, the bill now becomes the law. So, massage therapists can now begin taking their services out to where their clients live, work, study, and play.

Thank you for reading my articles throughout the first session of the 106th Legislature. It has been an honor for me to serve the constituents of Legislative District 47. I hope to see many of you at our parades, festivals, and fairs this summer. May God bless Nebraska!

Nebraska’s First Capitol Building, Douglas County, 1855

May 24th, 2019

Nearly 80 percent of Nebraskans say they need property tax relief. My highest priority as a Nebraska State Senator has been to provide significant and meaningful property tax relief to all Nebraskans.

For this reason I introduced LR3CA in the Nebraska Legislature earlier this year. LR3CA is a Legislative Resolution that would put a measure on the 2020 ballot, allowing Nebraskans to decide for themselves whether they need substantial property tax relief or not. The ballot measure associated with LR3CA is a constitutional amendment which would allow Nebraska property owners to claim 35 percent of their property tax bill as a credit or refund on their Nebraska State Income Tax Return.

Unfortunately, the Legislature’s Revenue Committee never advanced LR3CA out of committee. I anticipated that this would happen, so last year I began working with some concerned citizens who shared my concern for providing property tax relief for our residents. These concerned citizens began a petition drive to put the same measure as LR3CA on the 2020 ballot. Today you may visit their website at: www.truenebraskans.com.

The petition drive is going strong. Although a recent leadership dispute in the organization had to be overcome, it unfortunately lead to some misinformation about the petition drive being reported in the Lincoln Journal Star newspaper. That information should be read as fake news. Those running the petition drive are more organized than ever before, and I am confident that True Nebraskans LLC will be successful in putting this measure on your 2020 ballot. So, please consider signing it when it comes to your neck of the woods.

Another way I have sought to provide property tax relief to those who need it most is through LB 482, which I successfully amended onto LB 512. LB512 passed on Final Reading on Friday. My amendment is designed to bring property tax relief to those with destroyed property. I believe those suffering the destruction of their property by tornados, fires, and floods deserve property tax relief most. No one should have to pay property taxes on the full assessed value of their property on January 1 once nature leaves them with only the ghost of a house, a barn which no longer exists, or a damaged agricultural field.

The bill will direct County Assessors to reassess property for its value on the date of its destruction. Whatever the value is on the date of its destruction is what the value that property will have for the entire year. This will result in significant and meaningful property tax relief for those with destroyed property. However, in order to give each county board of equalization time to make reports and to hear appeals, this can only apply to those whose properties have been destroyed before July 1 of each year. Considering that most tornados and floods occur during the spring months, I believe most victims of natural disasters in our state will get the property tax relief they need.

The bill will cover those who have suffered losses from this year’s blizzards and floods. The amendment is retroactive to cover those whose properties have been destroyed since January 1, 2019. I expect Gov. Ricketts to sign the bill into law soon. So, if you have suffered property losses from this year’s blizzards and floods, please contact your County Assessor’s office right away. The deadline to apply for reassessment is July 15.

Finally, as we celebrate Memorial Day let us remember to honor those who have paid the ultimate price for our liberty. Throughout our history other nations have at times been ruled by evil men, who pursued acts of aggression against their own people, against other nations, and even against the United States. During those times the people of the United States of America rose up against those evil regimes and acted in the morally responsible way by sacrificing their own posterity to bring these tyrants down, restoring peace to the region, and spreading our values of freedom and human rights throughout the world. Remember, all gave some, and some gave all!

May 17th, 2019

The State Legislature is now in its final days of the 2019 legislative session. Only 12 days remain. State Senators have passed two budget bills on to Final Reading with the final round of debate coming up on May 21.

The main budget bill is LB 294. This bill increases State spending overall by 3.2 percent. I am not happy that we have advanced such a poor budget bill. Debate on the budget has been handled very poorly this year. Senators have proposed several amendments to LB 294, but they have never been given the opportunity to talk about them on the floor. Those who have concerns about the budget have been effectively shut down. So, I can honestly say that a full and fair debate has never taken place on the budget despite the fact that LB 294 has advanced.

Many Senators believe the State spends too much money and should cut the budget. But, the opportunity to share where these cuts could be made was obstructed by those in control and who insist on increasing State spending. Therefore, you should expect your taxes to remain high while the State continues to squander your tax dollars on programs that don’t work.

The State does not operate by the same rules private citizens do. When you do your budgeting you manage your finances based on how much money you have. That’s not how the State functions. I did not vote for this budget and I will not vote for LB 294 when it comes up on Final Reading. As your representative in the State Legislature, I know that you sent me to Lincoln to lower your taxes and to cut spending. So, that is what I intend to do with my one vote.

On May 15 we debated another very poorly designed bill. LB 720 is a bill to adopt the ImagiNE Nebraska Act. However, it should be more appropriately named: “The Just Imagine How High Your Taxes Can Go Act”! Therefore, I put a bracket motion on the bill to kill it which remains pending in the Legislature should it ever come back to the floor for another round of debate.

Sen. Mark Kolterman of Seward introduced this bill on behalf of the Chamber of Commerce. LB720 replaces the Nebraska Advantage Act which is set to sunset in 2020. The bill is a tax and spend bill which offers tax incentives to entice new businesses to move to our state; thus, creating new jobs.

The Nebraska Advantage Act did not work and neither will the ImagiNE Nebraska Act. So, let’s review some history to see what this kind of economic philosophy actually leads to. In 1987 the Legislature passed LB775, which appropriated $300 million towards these kinds of tax incentives for businesses.

Then, in 2005 the Legislature passed the Nebraska Advantage Act. The primary purpose of the Act was to keep ConAgra’s headquarters in Omaha. But, as we all know, that did not work. ConAgra moved to Chicago.

The last audit of the Nebraska Advantage Act showed that it cost the State anywhere from $7,800 to $208,000 in tax incentives per job created by the Act. The amount of earned income tax credits available in the Nebraska Advantage Act is currently $490 million. LB720, would add an additional $200 million to these tax incentives for a grand total of $990 million.

As a Legislator I have to concern myself with the State’s fiscal responsibilities. Wouldn’t the $1 billion be better spent on property tax relief? I think so. Unfortunately, the final days of house cleaning in the State Legislature will likely end with big money going to the Chamber of Commerce while the citizens get hung out to dry…again.

Thank you for the honor of taking up your concerns and representing you in the Nebraska Legislature. I will continue the fight for fiscal responsibility.

Sen. Steve Erdman

P.O. Box 94604

Lincoln, NE 68509

(402) 471-2616

Email: serdman@leg.ne.gov

- Column (371)

- District Info (8)

- Events (6)

- Opinion (2)

- Press Releases (13)

- Uncategorized (4)

- Welcome (1)

You are currently browsing the archives for the Column category.

-

Appropriations

Committee On Committees

Rules

Building Maintenance

Streaming video provided by Nebraska Public Media