NEBRASKA LEGISLATURE

The official site of the Nebraska Unicameral Legislature

Sen. Tony Vargas

District 7

The content of these pages is developed and maintained by, and is the sole responsibility of, the individual senator's office and may not reflect the views of the Nebraska Legislature. Questions and comments about the content should be directed to the senator's office at tvargas@leg.ne.gov

January 24th, 2019

Yesterday I had the opportunity to introduce LB50 to the Revenue Committee. I want to take a moment to talk about why LB50 is a common-sense proposal to both promote economic fairness, as well as generate revenue for our “Rainy Day Fund.”

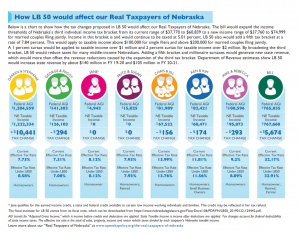

LB50 will rehaul Nebraska’s income tax brackets. Currently, everyone making more than $29,000 per year is taxed at the same rate of 6.84%. Under LB50, low and middle income-ea rners will be taxed at a lower rate. High income-earners will be taxed at a higher rate. People with incomes in excess of $1 million will pay an additional 1% in taxes and people with incomes of more than $2 million will pay an additional 2% in taxes. For more information about how this would affect people of different income levels, check out this helpful graphic from the OpenSky Policy Institute.

rners will be taxed at a lower rate. High income-earners will be taxed at a higher rate. People with incomes in excess of $1 million will pay an additional 1% in taxes and people with incomes of more than $2 million will pay an additional 2% in taxes. For more information about how this would affect people of different income levels, check out this helpful graphic from the OpenSky Policy Institute.

Over the past four years, Nebraska’s cash reserves, also known as our “Rainy Day Fund,” has been cut in half due to consistent downturns in projected revenue collected from state taxes. In addition, Nebraska’s population is rapidly aging and becoming increasingly urban. This massive demographic shift means that in our near future, there will be greater demands on services that can be harder to deliver in lower population areas.

LB50 will both generate revenue and ensure that our future generations have the same, if not more, opportunities than we do. Projected to increase revenue to the state by over $475 million over the next five years, LB50 will shore up our state’s financial future and enable us to continue delivering services that support “the Good Life.”

However, I am not the only one who is in favor of what LB50 would accomplish. In fact, a vast majority of Nebraskans are! A poll conducted in January of 2018 showed that nearly 8 in 10 Nebraskans support an income tax increase for people that earn more than $1 million per year. This is even broader support than Americans nationwide. A nationwide poll from January 12, 2019 shows 70% support for the same measure, including 56% of rural voters.

It is vital that as our state demographics continue to shift, and our cash reserves continue to deplete, we seek innovative ways to replenish our “Rainy Day Fund” and give ourselves room to grow. I am confident that should LB50 be adopted, it would have a tremendous positive impact on growing our state and ensuring its viability in the 21st century.

Sen. Tony Vargas

P.O. Box 94604

Lincoln, NE 68509

(402) 471-2721

Email: tvargas@leg.ne.gov

- Column (2)

- Uncategorized (29)

- Welcome (1)

-

Appropriations

Committee On Committees

Executive Board

Reference

Planning

Streaming video provided by Nebraska Public Media