NEBRASKA LEGISLATURE

The official site of the Nebraska Unicameral Legislature

Sen. Joni Albrecht

District 17

The content of these pages is developed and maintained by, and is the sole responsibility of, the individual senator's office and may not reflect the views of the Nebraska Legislature. Questions and comments about the content should be directed to the senator's office at jalbrecht@leg.ne.gov

September 13th, 2024

This past week we remembered what happened on September 11, 2001 also known as Patriot Day. Governor Pillen announced that all U. S and Nebraska flags were to be flown at half-staff from sunrise to sunset on September 11th. “September 11 is a solemn day in our nation’s history. It is important that we collectively remember those who were lost and honor what their sacrifice still symbolizes today,” said Governor Pillen. “Twenty-three years later, our resolve remains. We take nothing for granted, especially those freedoms we hold most dear.” (Strimple, Laura and Urlis, Allan. Press Release. “Flags to Fly at Half-Staff on Patriot Day”. 10 September, 2024. https://shorturl.at/gTRI9)

A 9-11 Remembrance Ceremony was held on the east side of Freedom Park in South Sioux City on September 11th. Representatives of law enforcement, public safety and American Legions around the area, along with VFW and Legion Riders members, were recognized for their service to the community and country. The program included the “four fives”, a striking of a bell in a series of four groups of five rings, symbolizing the firefighter who died in the line of duty and didn’t return home. A 21-gun salute, the playing of taps, and a flag retirement ceremony by American Legion veterans that included the burning of about 5,000 unserviceable flags. (Carnes, Michael. “An evening to remember: 9-11 ceremony held at Freedom Park”. Dakota County Star, 12 September, 2024. https://dakcostar.com/stories/an-evening-to-remember,4121?)

Over the past few weeks, I have heard concerns about what was really accomplished during Governor Pillen’s Special Session and what is really in LB34. On Friday, September 6th, the Department of Revenue put out the following press release.

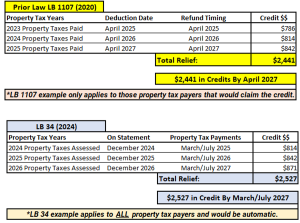

The Nebraska Department of Revenue (DOR) is providing information on property tax relief changes resulting from a new credit through the passage of LB 34 (2024). The bill frontloads the credit of 30% of school district taxes paid automatically by reducing property tax statements instead of requiring the taxpayer to claim it as a refundable income tax credit. The total amount of the frontloaded relief is $750 million that will reduce 2024 property tax statements. This credit is set to increase by a minimum of 3% each year and as the state’s economy grows, LB 34 includes a provision to direct even more funding to property tax relief.

Previously under LB 1107 (2020), approximately 45% of Nebraskans were not claiming the property tax credit when filing their income tax returns. Now, through LB 34, those taxpayers will experience upwards of 20% in direct property tax relief. For those taxpayers who previously claimed those tax credits, LB 34 will continue to provide property tax relief, without the burden of filing a claim. Taxpayers will now receive the benefit much earlier in the process. The new frontloaded credit will appear on each taxpayer’s 2024 property tax statement, which will be mailed in December 2024.

The frontloading of this credit only applies to school district taxes, so there is no change to the community college tax credit, which must still be claimed by taxpayers on their income tax return. This credit does still provide a 100% refund of community college taxes paid by the taxpayer.

Provided below is a comparative analysis considering prior law and LB 34 changes utilizing the average tax credit Nebraska property taxpayers would receive in each respective year:

*Taxpayers in Douglas, Lancaster, and Sarpy Counties pay property taxes by April 1 and August 1.

*Taxpayers outside of Douglas, Lancaster, and Sarpy Counties pay property taxes by May 1 and September 1.

LB 34 provides equitable property tax relief to all Nebraskans. Every property owner will receive the same benefit of a 30% reduction in school district property taxes paid. It is critical that Nebraskans automatically receive this credit rather than loaning government funds for a full year. The bill ensures that this property tax credit increases by a minimum of 3% per year and grows as Nebraska’s economy does. Another critical part of LB 34 is putting caps on growth for local government property taxes to ensure we receive long term property tax reform. (Roy, Patrick. Press Release. “Special Session Update: LB 34”. 6 September, 2024. https://shorturl.at/wYREP)

You must remember that we have frontloaded the property tax relief. This means you will no longer have to claim the public school property tax credit on your taxes on your income tax return after you have already paid the taxes. It will now show up on your property tax statement as a credit. You will no longer receive a physical check or direct deposit into your bank account. This will be a change that will take some time to adjust to as this property tax has been in effect since 2020.

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

Sen. Joni Albrecht

P.O. Box 94604

Lincoln, NE 68509

(402) 471-2716

Email: jalbrecht@leg.ne.gov

- Column (90)

- District Info (3)

- Press Releases (2)

- Uncategorized (223)

- Welcome (1)

-

Committee On Committees

Revenue

Transportation and Telecommunications

State-Tribal Relations

Streaming video provided by Nebraska Public Media