NEBRASKA LEGISLATURE

The official site of the Nebraska Unicameral Legislature

Sen. Joni Albrecht

District 17

The content of these pages is developed and maintained by, and is the sole responsibility of, the individual senator's office and may not reflect the views of the Nebraska Legislature. Questions and comments about the content should be directed to the senator's office at jalbrecht@leg.ne.gov

October 4th, 2024

The weather seems to be having trouble making up its mind on what it wants to do. It has been very up and down. One of the many concerns we have is Red Flag Warnings being issued by the National Weather Service. A Red Flag Warning means that critical fire weather conditions are either occurring now, or will shortly. A combination of strong winds, low relative humidity and warm temperatures can contribute to extreme fire behavior. I would encourage everyone to take the following precautions:

- If you have planned a prescribed burn, immediately cancel the planned operations. Do NOT burn on a red flag day.

- If pulling a trailer, make sure no chains are dragging; sparks from dragging chains can ignite a fire.

- Dispose of cigarettes properly; DO NOT drop lit cigarettes on the ground or throw them out the window.

- Be especially aware when using fire arms or target shooting.

- Avoid mowing the lawn on red flag days.

- Avoid leaving equipment on areas with dry vegetation.

- Avoid parking vehicles on dry vegetation. It is best to park on bare soil or paved surfaces.

- Make sure chainsaws and other equipment have spark arrestors.

- Pay attention to other restrictions such as no open fires.

- Avoid using charcoal or gas grills on red flag days.

All residents and visitors need to be extremely cautious during periods of high fire danger. One spark can lead to a large, damaging wildfire. (Nebraska Forest Service. (2017) Red Flag Warning: Critical fire weather conditions. [Brochure] Retrieved October 2, 2024, from https://shorturl.at/2zn1J) A huge shout out to our local firefighters and first responders as they do such a great job in responding to the call and helping keep our communities safe. I would be remiss in not recognizing the farmers for bringing their own equipment to help fight the fires as well.

Fire Prevention Week is October 6-12 and this year’s campaign “Smoke Alarms: Make them work for you!” strives to educate everyone about the importance of having working smoke alarms in the home. Some key smoke alarm safety tips and guidelines are 1) Install smoke alarms in every bedroom, outside each separate sleeping area (like a hallway) and on each level (including the basement) of the home; 2) Test smoke alarms at least once a month by pushing the test button; 3) Replace all smoke alarms when they are 10 years old or stop responding when tested; and 4) Make sure smoke alarms meet the needs of all family members, including those with sensory or physical disabilities. (NFPA Fire Prevention Week (FPW) (2024) nfpa.org. Available at: https://shorturl.at/OLxaI (Accessed: 02 October 2024).

This week I would like to talk about the final two proposed amendments and initiatives that you will see on your ballot. I will cover the ‘Nebraska Medical Cannabis Patient Protection Initiative’ and the ‘Nebraska Medical Cannabis Regulation Initiative’.

The ‘Nebraska Medical Cannabis Patient Protection Initiative’ (Initiative Measure 437) says Shall a statute be enacted that makes penalties inapplicable under state and local law for the use, possession, and acquisition of an allowable amount (up to five ounces) of cannabis for medical purposes by a qualified patient with a written recommendation from a health care practitioner, and for a caregiver to assist a qualified patient with these activities? A vote “FOR” will enact the statute and a vote “AGAINST” means such a statute will not be enacted.

Supporters contend that the goal of Initiatives 437 and 438 is to create safe and regulated access to medical cannabis for Nebraska patients with the recommendation of a healthcare practitioner. Initiative 437 provides Nebraskans the ability to possess medical cannabis. Initiative 438 provides the regulatory framework. The National Academies of Sciences released a report that reviewed overt 10,000 academic studies. It found substantial evidence that cannabis is effective in treating chronic pain, multiple sclerosis, anxiety, and PTSD. Research also indicates effectiveness in treating epileptic seizures and autism. A 2015 study compared cannabis to many other commonly used substances. The DEA (Drug Enforcement Administration) confirms “[N]o deaths from overdose of marijuana have been reported.” Compared to many prescription drugs, cannabis is safer and less addictive.

Opponents contend that the Medical Cannabis Patient Protection Initiative contradicts federal law by legalizing cannabis in all forms, including marijuana, hashish, and concentrates, and the possession of drug paraphernalia. State and local laws cannot restrict the use, possession, or acquisition of cannabis in the workplace, schools, or any private or public space. While a medical professional must provide a certification of a medical condition, it is not a prescription, nor is it to be dispensed by a licensed pharmacist. The individual obtaining the certificate to possess and use cannabis does not have to be a patient of the certifying medical provider, nor are there restrictions on the type, dose, or frequency of administration. Basic patient protections such as safety, purity, or efficacy of the product are not required.

The ‘Nebraska Medical Cannabis Regulation Initiative’ (Initiative Measure 438) says Shall a statute be enacted that makes penalties inapplicable under state law for the possession, manufacture, distribution, delivery, and dispensing of cannabis for medical purposes by registered private entities, and that establishes a Nebraska Medical Cannabis Commission to regulate such activities? A vote “FOR” will enact the statute and a vote “AGAINST” means such a statute will not be enacted.

Supporters contend the same view as for Initiative Measure 437.

Opponents contend that The Medical Cannabis Regulation Initiative legalizes a commercial cannabis industry in Nebraska in contradiction to current federal law. The initiative will facilitate possession and the commercial manufacture, distribution, delivery and dispensing of cannabis in all forms, including marijuana, hashish, and derivatives. The initiative allows the establishment of businesses and use of business equi9pment for the industrial production of any cannabis product for ingesting, inhaling, or otherwise introducing the drug into the body, with no restriction on production for medical purposes only. In addition, the initiative creates a new government agency, the Nebraska Medical Cannabis Commission, whose appointed board will oversee the newly legalized cannabis industry in Nebraska. This new government entity is granted the power to promulgate and enforce rules and regulations.

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

September 27th, 2024

Harvest is just getting started or will start in the next few weeks. This past week was National Farm Safety and Health Week. On September 25th the Nebraska State Patrol posted on their Facebook page “This week is National Farm Safety and Health Week! As harvest season continues remember to stay safe on the roads with these three tips:

✅Label slow-moving equipment with necessary Slow Moving Vehicle (SMV) signs.

✅Ensure all equipment has sufficient lighting, reflective tape, and reflectors.

✅Perform regular maintenance on farm vehicles and equipment.”

I also want to encourage all drivers to be alert for agricultural equipment on the roads during harvest season. The Nebraska State Patrol is encouraging all drivers to be aware of agriculture equipment on roads throughout the state. “Agriculture plays a major role in our state. As ag producers continue their harvest, all motorists should stay alert for slow-moving ag implements,” said Captain Martin Denton, Commander of NSP Carrier Enforcement. Due to the size, shape, and loads, driver visibility is often reduced. Drivers should stay cautious when approaching, following, or attempting to pass farm vehicles. (Portions taken from 10/11NOW. (2024, September 25). Nebraska State Patrol urges drivers to be alert for agriculture equipment during harvest season. https://www.1011now.com. https://shorturl.at/w7SAj)

This week I would like to talk about two more proposed amendments and initiatives that you will see on your ballot. I will cover ‘Paid Sick Leave’ and the ‘Private Education Scholarship Referendum’.

‘Paid Sick Leave’ (Initiative Measure 436) says Shall a statute be enacted which: (1) provides eligible employees the right to earn paid sick time for personal or family health needs; (2) entitles employees of employers with fewer than 20 employees to accrue and use up to 40 hours of such time annually and those employed by employers with 20 or more employees to accrue and use up to 56 hours of such time annually; (3) specifies conditions regarding paid sick time; (4) prohibits retaliation against employees for exercising such rights; (5) adopts documentation requirements; and (6) establishes enforcement powers and a civil cause of action or violations. A vote “FOR” will enact the statute and a vote “AGAINST” means such a statute will not be enacted.

Supporters contend that no Nebraskan should have to choose between their paycheck and their health or the health of their family. It’s time to support working Nebraskans so they can take care of their health without losing pay. Initiative 436 would allow Nebraska workers to earn one hour of paid sick leave for every 30 hours worked. This will benefit full-time, part-time and temporary employees creating healthier workplaces, families, and communities. If passed by the majority of voters, Initiative 436 would go into effect on October 1, 2025.

Opponents contend that government-mandated paid leave will hurt small and medium-sized businesses by driving up their cost of doing business and making it harder for them to compete with large national and multinational corporations. Because mandates passed by petition must be written narrowly, this proposal disproportionately hurts small businesses located in rural and lower income areas because it does not account for differences in labor availability, cost-of-living, or other variances across the state. This initiative is a one-size-fits-all government mandate, backed by millions of dollars from outside Nebraska. If passed, it will drive up compliance costs and increase prices for consumers who would otherwise like to shop at local retailers.

‘Private Education Scholarship Referendum’ (Referendum Measure 435) says Section 1 of Legislative Bill 1402, enacted by the Nebraska Legislature in 2024, provides for $10 million annually to fund education scholarships to pay all or part of the cost to educate eligible students attending nongovernmental, privately operated elementary and secondary schools in Nebraska. A vote to “RETAIN” will keep in effect Section 1 of Legislative Bill 1402 enacted in 2024 by the Nebraska Legislature. A vote to “REPEAL” will eliminate the funding and scholarship provisions in Section 1 of Legislative Bill 1402.

Opponents contend that Referendum 435 gives voters the choice to retain an education scholarship program, created by a bipartisan super-majority of the Legislature, that empowers families to choose the school that is the best fit for their child. Repealing the program would eliminate record investment in Nebraska schools and block education freedom reforms that empower parents and hold schools accountable. The education scholarship program is benefiting thousands of Nebraska students and repeal will take away scholarships from those students. Repeal would steal hope and opportunity from thousands of families and children from across Nebraska who are benefiting from a new school setting where they have a better chance to learn and succeed in school.

Supporters contend that a vote to REPEAL LB1402 will eliminate a Legislative program that uses public funds to pay for private school tuition. The $10 million in public funds given to pay for private school tuition would otherwise be available to support local public schools, which serve 90% of all children in Nebraska. Private schools are not held to the same taxpayer accountability and transparency standards as public schools. LB1402 is inequitable. Private schools can discriminate against kids–they pick and choose the children they want to enroll. Public funds should be used for public education that is available to all Nebraska students. Indeed, more than half of Nebraska’s 93 counties do not have a private school. Nebraska taxpayers cannot afford to fund two separate school systems.

NDOT State Highway Construction & Detour report

for Northeast Nebraska

This update is from the September 25, 2024 Nebraska Interstate & Highway Construction & Detour Report. This report does not include Waze reports, construction and maintenance projects that will take less than 30 days to complete, rough roads reports, rest area information, and traffic accidents. Call 511 or visit www.511.nebraska.gov for the most current information.

- US-77 in both directions between mile marker 164 and Whitestocking Lane (1 to 7 miles south of Winnebago). Road construction work is in progress.

- US-77 in both directions between County Road Q (6 miles north of Oakland) and NE-94 (6 miles south of Winnebago). Long term road construction. A lane is closed intermittently. Guardrails are being repaired. There is a 12-foot width limit. Anticipated completion is December 2024.

- NE-9 in both directions between Willis Street (near Pender) and Prairie Street (Emerson). Bridge construction. A lane is closed intermittently. Look out for temporary traffic lights. There is a 12-foot width in effect.

- NE-16 IN BOTH DIRECTIONS ROAD CLOSED FOR REPAIRS between NE-51; County Road W51 and NE-9 (Bancroft). The road is closed for resurfacing. Anticipated completion is September 2024.

- NE-57 in both directions between 859th Road and 860th Road (near Carroll). Road construction work is in progress, bridge repair. The roadway is reduced to one lane. Traffic maintained with temporary traffic lights and flaggers. There is a 12-foot width limit in effect.

- NE-57 in both directions between 857th Road and 858th Road (2 miles south of Carroll). Road construction work is in progress, bridge repair. The roadway is reduced to one lane. Traffic maintained with temporary traffic lights and flaggers. There is a 12-foot width limit in effect.

- NE-87B Spur Rosalie Spur in both directions between US-77 and Farley Street (3 miles east of Rosalie). Long term road construction work. A lane is closed intermittently. Guardrails are being repaired. Anticipated completion is December 2024.

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

September 20th, 2024

The feeling of fall is in the air as we have seen cooler temperatures in recent weeks. The autumnal equinox took place on September 22nd and marks the end of summer and the beginning of fall. Harvest will start soon as well as watching the trees turn their beautiful fall colors. Days will begin to get shorter and shorter leading up to the holidays ahead.

As you are all aware, election day is right around the corner. On November 5, 2024, you will be asked to vote for the president and vice president of the United States, your Senator and Representative to Congress, your Nebraska State Senator, and many other offices at the local level.

First of all, I would encourage you to make sure you have registered to vote. This is one of the most important rights you have as a United States citizen. In order to vote in Nebraska, you must be a United States citizen; live in the state of Nebraska; be at least 18 years of age on or before the first Tuesday after the first Monday in November; have not been convicted of a felony, or if convicted, your civil rights have been restored; and have not been officially found to be mentally incompetent. The online registration deadline to register is 11:59.59 p.m. Central Time on the third Friday before the election. The only thing you need to register online is your Nebraska driver’s license or state-issued identification card. If you are not sure you have registered to vote, go to https://www.votercheck.necvr.ne.gov/voterview and enter your information. It will tell you if you are registered and where your polling location is. (Nebraska Secretary of State (n.d). Online voter registration frequently asked questions. Nebraska Secretary of State–Voter Registration Portal FAQs)

Over the next several weeks I would like to highlight the ballot initiatives and referendums that will be on the 2024 General election ballot. It is good to do our research and know what we as voters are being asked to approve or not approve for the Nebraska Constitution through initiatives and referendums so we are informed when we fill out our ballot. Bob Evnen, Nebraska Secretary of State, certified the final list of candidates on Friday, September 13th. Many of these ballot initiatives were challenged before the Nebraska Supreme Court and their rulings came out before the certification of the 2024 ballot.

There have been six initiative and referendum ballot measures. They include ‘Protect Women and Children’; Private Education Scholarship Partial Referendum’; ‘Paid Sick Leave’; ‘Nebraska Medical Cannabis Patient Protection’; ‘Nebraska Medical Cannabis Regulation’; and ‘Protect the Right to Abortion’. This means that each initiative met the threshold for signatures and now goes to the voters of Nebraska. Per state law, Bob Evnen will hold hearings on the ballot measures in each of Nebraska’s three congressional districts. (Augustine, M. (2024, September 13). Commitment 2024: Nebraska Secretary of State certifies November ballot. KETV Omaha. https://shorturl.at/O0jUE.) This week I would like to talk about ‘Protect Women and Children’ and ‘Protect Our Right to Abortion’ initiatives.

‘Protect Women and Children’ (Initiative Measure 434) says Except when a woman seeks an abortion necessitated by a medical emergency or when the pregnancy results from sexual assault or incest, unborn children shall be protected from abortion in the second and third trimesters. This initiative creates basic constitutional protections for preborn children in Nebraska. If passed, Nebraska would be the first state in the nation to provide constitutional protection to preborn children in a state constitution. This initiative establishes a floor of protection, not a ceiling, meaning preborn children must, at a minimum, be protected by the second trimester, and stronger pro-life laws could still be passed going forward. This initiative would retain current Nebraska law that prevents elective abortions after 12 weeks with noted exceptions. (Nebraska Family Alliance. (2024). Protect women and children Nebraska. https://shorturl.at/eVVe2.)

‘Protect the Right to Abortion’ (Initiative Measure 439) says All persons shall have a fundamental right to abortion until fetal viability, or when needed to protect the life or health of the pregnant patient, without interference from the state or its political subdivisions. Fetal viability means the point in pregnancy when in the professional judgment of the patient’s treating health care practitioner, there is a significant likelihood of the fetus’ sustained survival outside the uterus without the application of extraordinary medical measures. This initiative contains a vague “health exception” determined entirely by the abortionist. Exceptions could include non-physical factors, such as emotional, spiritual, and financial health. This opens the door to abortions up until birth. Viability is defined as being solely based on the abortionist’s judgment and would allow abortions in the second and third trimesters. Babies feel pain before viability–at 15 weeks or earlier. Babies who can experience pain would be subjected to painful late-term abortions. The initiative creates a fundamental right to abortion for “all persons,” including children and minors. This would eliminate our state’s parental consent law, meaning parents will not have any ability to consent or even know if their child seeks or obtains an abortion. Furthermore, the negation of parental notification laws could lead to the protection of child predators and human traffickers. A “fundamental right to abortion without interference from the state” puts existing medical safeguards that protect the health and safety of women at risk of being eliminated. This includes informed consent statutes and requirements that the abortion be performed in person and by a licensed doctor. (Nebraska Family Alliance. (2024). Protect women and children Nebraska. https://shorturl.at/eVVe2.)

As you can see, these two initiatives are very different from one another. I would encourage you to make sure you read the wording of each one carefully. Make sure you know what you are voting for when you check “Yes” or “No”.

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

September 13th, 2024

This past week we remembered what happened on September 11, 2001 also known as Patriot Day. Governor Pillen announced that all U. S and Nebraska flags were to be flown at half-staff from sunrise to sunset on September 11th. “September 11 is a solemn day in our nation’s history. It is important that we collectively remember those who were lost and honor what their sacrifice still symbolizes today,” said Governor Pillen. “Twenty-three years later, our resolve remains. We take nothing for granted, especially those freedoms we hold most dear.” (Strimple, Laura and Urlis, Allan. Press Release. “Flags to Fly at Half-Staff on Patriot Day”. 10 September, 2024. https://shorturl.at/gTRI9)

A 9-11 Remembrance Ceremony was held on the east side of Freedom Park in South Sioux City on September 11th. Representatives of law enforcement, public safety and American Legions around the area, along with VFW and Legion Riders members, were recognized for their service to the community and country. The program included the “four fives”, a striking of a bell in a series of four groups of five rings, symbolizing the firefighter who died in the line of duty and didn’t return home. A 21-gun salute, the playing of taps, and a flag retirement ceremony by American Legion veterans that included the burning of about 5,000 unserviceable flags. (Carnes, Michael. “An evening to remember: 9-11 ceremony held at Freedom Park”. Dakota County Star, 12 September, 2024. https://dakcostar.com/stories/an-evening-to-remember,4121?)

Over the past few weeks, I have heard concerns about what was really accomplished during Governor Pillen’s Special Session and what is really in LB34. On Friday, September 6th, the Department of Revenue put out the following press release.

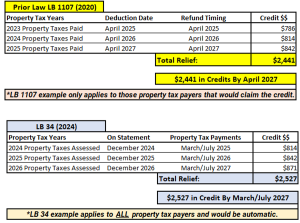

The Nebraska Department of Revenue (DOR) is providing information on property tax relief changes resulting from a new credit through the passage of LB 34 (2024). The bill frontloads the credit of 30% of school district taxes paid automatically by reducing property tax statements instead of requiring the taxpayer to claim it as a refundable income tax credit. The total amount of the frontloaded relief is $750 million that will reduce 2024 property tax statements. This credit is set to increase by a minimum of 3% each year and as the state’s economy grows, LB 34 includes a provision to direct even more funding to property tax relief.

Previously under LB 1107 (2020), approximately 45% of Nebraskans were not claiming the property tax credit when filing their income tax returns. Now, through LB 34, those taxpayers will experience upwards of 20% in direct property tax relief. For those taxpayers who previously claimed those tax credits, LB 34 will continue to provide property tax relief, without the burden of filing a claim. Taxpayers will now receive the benefit much earlier in the process. The new frontloaded credit will appear on each taxpayer’s 2024 property tax statement, which will be mailed in December 2024.

The frontloading of this credit only applies to school district taxes, so there is no change to the community college tax credit, which must still be claimed by taxpayers on their income tax return. This credit does still provide a 100% refund of community college taxes paid by the taxpayer.

Provided below is a comparative analysis considering prior law and LB 34 changes utilizing the average tax credit Nebraska property taxpayers would receive in each respective year:

*Taxpayers in Douglas, Lancaster, and Sarpy Counties pay property taxes by April 1 and August 1.

*Taxpayers outside of Douglas, Lancaster, and Sarpy Counties pay property taxes by May 1 and September 1.

LB 34 provides equitable property tax relief to all Nebraskans. Every property owner will receive the same benefit of a 30% reduction in school district property taxes paid. It is critical that Nebraskans automatically receive this credit rather than loaning government funds for a full year. The bill ensures that this property tax credit increases by a minimum of 3% per year and grows as Nebraska’s economy does. Another critical part of LB 34 is putting caps on growth for local government property taxes to ensure we receive long term property tax reform. (Roy, Patrick. Press Release. “Special Session Update: LB 34”. 6 September, 2024. https://shorturl.at/wYREP)

You must remember that we have frontloaded the property tax relief. This means you will no longer have to claim the public school property tax credit on your taxes on your income tax return after you have already paid the taxes. It will now show up on your property tax statement as a credit. You will no longer receive a physical check or direct deposit into your bank account. This will be a change that will take some time to adjust to as this property tax has been in effect since 2020.

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

August 30th, 2024

On Wednesday, August 28th, Mike and I traveled to Grand Island to visit the Nebraska State Fair. We toured the 4-H building as we do every year to look at the many entries from the district and our grandchildren’s entries from Dodge County and Dakota Thurston County. We enjoyed watching our granddaughter march down Main Street with the Mead marching band. We ended up visiting with a gentleman from Kansas who said he was impressed by the amount of 4-H participation going on at the state fair. We saw bus loads of children coming to visit the state fair and enjoyed the wonderment in their eyes as they saw everything available to see. I would like to say thanks to those on the Nebraska State Fair board and all the volunteers that are helping make the state fair a success. We had a delightful experience and realized that we are unable to see everything in one day. We should plan two days. Congratulations on a great 2024 Nebraska State Fair!

Special Session Bill Updates

I have had some questions over the weekend about LB34 and would like to clarify what was accomplished during special session. In Governor Pillen’s August 22nd column, he stated that because we frontloaded the Property Income Tax Credit to property tax statements, 45% of Nebraskans who were not claiming this on their income tax return, will now receive a 20% tax savings while those who were claiming this property tax credit will see approximately 3% property tax savings. Nebraskans will also see relief as we included caps on local spending authority for cities and counties. Most people view out of control valuation increases as the problem. Excess spending is the real issue. As valuations were increased, levies were supposed to decrease, but it is very obvious that this was not being done at the local level. This will decrease property tax increases by county and city governments. (Portions from Pillen, Governor Jim. Weekly Column. “Property Tax Reform: We Need to Do More”. 22 August, 2024. https://shorturl.at/u3pqb)

Exemptions to this include:

- approved bonds,

- response to a declared emergency,

- amount of unused property tax request authority that may be carried forward to future budget years,

- increase in property tax request authority approved by voters,

- amount of property taxes budgeted for public safety services (crime prevention, offender detention, and firefighter, police, medical, ambulance or other emergency services), and

amount of property taxes budgeted for public safety services, county attorneys, and public defenders.

We also approved two budget measures to help offset a future shortfall in funding the property tax relief proposal. LB2, introduced by Senator Robert Clements of Elmwood at the request of Governor Pillen, makes adjustments to the state budget that was finalized in the recently concluded regular legislative session. This bill reappropriated general funds–also known as carryover funds–by $82 million across more than 40 state agencies in the current fiscal year (FY) and FY 2024-25. LB2 also lowers general fund appropriations by $41.46 million. In total the proposal reduces funds available to state agencies by approximately $120 million.

LB3, also introduced by Senator Clements at the request of the governor, authorizes and provides for fund transfers, changes certain fund transfer provisions, and changes application of investment earnings. Among other provisions, LB3 eliminates the crediting of accrued interest to more than 40 state agency cash funds. These dollars instead will be directed to the state’s General Fund. This bill is projected to increase state revenue by $22 million in 2025, $80 million in 2026, and $71 million in 2027. It also states legislative intent to transfer $200 million to the General Fund from the state’s Cash Reserve Fund in 2027 if needed and if funds are available. (“Budget bills clear final round”. Unicameral Update. 20 August, 2024. https://update.legislature.ne.gov/?p=36838)

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

August 23rd, 2024

Last Tuesday, August 20th, we finished up the special session Sine Die after passing property tax legislation along with the two budget bills making adjustments to the biennial budget and approving the bill to fund the special session.

When we passed LB1107 in 2020, it was to help with property tax relief. It created a refundable income tax credit based on the amount an eligible taxpayer paid in property taxes to their school district during the previous year, not including those amounts levied for bonds or levy overrides. The credit is allowed to each individual, business, or other entity that pays school district taxes. In 2022 we added credit for both school district and community college property taxes paid. As we approached special session, we found out that 40-45% of Nebraskans were not claiming this property tax credit on their income tax return and determined that it would be a good idea to frontload the property tax credit so you would see it on your property tax statement. (Portions taken from “Tax package clears final round after cloture vote”. Unicameral Update. 13 August, 2020. https://update.legislature.ne.gov/?p=28523)

LB34 passed with an emergency clause 40-3. Governor Pillen then signed it into law on August 20th. Under LB34, introduced by Senator Tom Brewer of Gordon, a city, county, or village may increase its property tax request authority. This bill is quite simple and does two things:

- It puts a cap on property taxes levied by cities, counties, and villages at 0% or the inflation rate determined by the State and Local Consumption Expenditures and Gross Investment rate for a prior year, whichever is greater.

- Frontloads the refundable income tax credit so you will see it on your property tax statement rather than claim it the following year on your income tax return.

Exemptions to this include:

- approved bonds,

- response to a declared emergency,

- amount of unused property tax request authority that may be carried forward to future budget years,

- increase in property tax request authority approved by voters,

- amount of property taxes budgeted for public safety services (crime prevention, offender detention, and firefighter, police, medical, ambulance or other emergency services), and

- amount of property taxes budgeted for public safety services, county attorneys, and public defenders.

LB34 requires the state treasurer to transfer $750 million in general funds–including the approximately $565 million allocated to the refundable income tax credit program–to the new program in fiscal year 2024-2025. If the General Fund net receipts increase by more than 3% annually, the excess amount will be transferred to the new program’s cash fund. (“Cap on local tax asking, additional property tax relief approved”. Unicameral Update. 20 August, 2024. https://update.legislature.ne.gov/?p=36836)

Following the passage of these bills, Governor Pillen hosted a press conference and bill signing with invited state senators who supported passage of legislative initiatives introduced during the special session aimed at fixing the state’s rising property tax crisis. “LB 34 is an important step forward,” said Governor Pillen. “I appreciate the efforts of Senator Lou Ann Linehan, members of the Revenue and Appropriations committees and the other senators here today who brought substantive ideas and fought hard on behalf of Nebraskans. This is not a one-and-done issue. It’s the top concern that Nebraskans talk to me about wherever I go, and it needs to be addressed so we are no longer chasing seniors out of their homes and killing the dream of home ownership for young people.”

Senator Linehan touted the significance of limiting taxing authority by cities and counties year-over-year to the greater of inflation or 0% saying, “Putting caps on spending is the only real answer to fixing this. The reason our property taxes are high is because we have too many taxing authorities spending too much money. Finally, anything that is over three percent in revenue growth can go to property tax relief.”

State Treasurer Tom Briese congratulated his former legislative colleagues for their work, but echoed sentiments that the pursuit for more substantive property tax relief was far from over. He pointed to LB 1 which he said would have significantly addressed the property tax issue and was almost unanimously approved by the Governor’s working group. “Unfortunately, lobbyists and special interests got in the way. Going forward, they will need to decide if they are serious about property tax relief, or they just want to talk about it,” cautioned Treasurer Briese. (Strimple, Laura and Urlis, Allan. Press Release. “Gov. Pillen Touts Passage of Bills at Signing Ceremony, Says Much More is Left to Be Done for Property Tax Relief”. 20 August, 2024. https://shorturl.at/nSeEV)

I personally came down to Lincoln to get 40% relief at a minimum, but 50% was preferred. I have been a member of both of Governor Pillen’s Property Tax Working Groups where we diligently worked hard to find a good solution to the property tax crisis. Unfortunately, those at the table were not as on board with the plan as they portrayed at the meetings. Lobbyists worked against us in order to keep their exemptions. They fought against adding any sales taxes.

On a positive note–we answered the call Governor Pillen set forth in his proclamation declaring a special session. Even though the final product didn’t look like what we wanted, we were able to help get the process started. I know the new group of State Senators can continue pursuing property tax relief. I am sure we will see many bills introduced in 2025 that will address ways to work toward property tax relief.

NDOT Current Road Construction update

Work began on Friday, August 23rd, on US-77 between Lyons and Walthill. Work will include asphalt overlay, concrete pavement repair, and culvert work. Traffic will be maintained with a pilot car and flaggers. Anticipated completion is mid-summer 2025. Motorists are reminded to drive cautiously in and near work zones, to buckle up, and to put phones down.

Work is continuing on NE-9 in both directions between Willis Street (near Pender) and Prairie Street (Emerson). Bridge construction. A lane is closed intermittently. Look out for temporary traffic lights. There is a 12-foot width in effect.

With road construction going on and school starting up, please make sure you keep your eyes open for students and school buses as school gets into full swing as well as the road construction workers working on the roads in our area. Just a reminder that fines for speeding are doubled for exceeding the posted speed limit in construction zones and in school crossing zones.

This past weekend I enjoyed participating in the Hubbard Hoot Owl Days by being in the parade and taking in the many activities going on. The previous weekend Mike enjoyed attending Wakefest in Wakefield as I was in special session in Lincoln. It has been nice to attend and participate in the many community celebrations going on in District 17 over the past several weeks. I have enjoyed seeing many familiar faces. There is still much work to be done in the interim as I finish up my time as your State Senator.

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

August 19th, 2024

Last week the special session continued as we worked to hammer out what the property tax relief package would look like. There is a lot of disagreement on what is the right way to address this very important issue in the state of Nebraska. What I shared in my last newsletter has developed into something different. I do believe now is the time to address the property tax crisis. We have all been called back to the State Legislature by Governor Pillen and we need to address this now.

Our state and our taxing authorities have a spending problem. Our state has reduced its state spending by $140 million which is a 2.5% reduction in spending. ALL taxing authorities MUST take a hard look at their budgets. This is not a valuation issue, but a levy problem as well as a spending problem. Just as we have to adjust our own personal budgets in order to make sure we are spending our income properly, the taxing authorities and state government must look at their budgets and tighten their belts to make sure they are spending correctly. It is in Nebraska state law that when valuations go up, levies shall reduce accordingly.

We need to broaden the base or we won’t get relief. There are $7 billion in sales tax exemptions and no one wants to give up their exemptions. Strength comes when everyone comes to the table and is willing to negotiate in good faith. Nebraska will begin looking at ALL taxing authorities to see how taxes are being used. The lobby has done a good job of bringing division to our body. It seems to be okay for some to keep their tax exemption, but not for others. Everyone needs to give a little to get a little. Everyone needs to come to the sandbox to play.

We pivoted to funding schools as it was never the intention of the state to fund public schools using property taxes. Currently, taxes paid to school districts comprise the largest share of most individuals’ tax bills. School districts levy nearly 60% of the total property taxes collected. Recent increases in agricultural land valuation have greatly impacted state aid to schools through TEEOSA (Tax Equity and Educational Opportunities Support Act). School districts are eligible to receive state aid through TEEOSA to supplement property tax revenue. Part of TEEOSA’s funding formula is based upon the property tax resources available in the district. Over the past few years, an increasing number of schools have become non-equalized and do not receive any state funds. These school districts, largely in rural areas, must then rely solely on property taxes. The formula is obsolete and MUST be revamped. Large schools will soon not be able to capitalize on the formula.

On Tuesday, August 20th, (day 17 of Special Session) we will either move forward with LB34 and Sine Die or if LB34 doesn’t pass, we could be there longer with other ideas presented. Stay tuned.

News from the Governor’s office

On August 7-8, Governor Pillen welcomed 600 leaders to Younes Conference Center North in Kearney for “One Nebraska: the Governor’s Summit on Ag and Economic Development” co-hosted by the Nebraska Department of Economic Development (DED) and the Nebraska Department of Agriculture (NDA).

“We have unique strengths as a state that we can brag about to bring in business,” said Governor Jim Pillen. “Nebraska has amazing people, abundant natural resources, and the most sustainable ag production on the planet. The Summit is a tremendous opportunity to strategize together about how we can make the most of these competitive advantages.”

This year’s event included a focus on retaining graduates and attracting new residents to Nebraska. The Summit also included an emphasis on Nebraska’s bioeconomy–exploring how the state can feed the world and fuel the future while contributing to a cleaner environment. The Nebraska Department of Natural Resources (NeDNR) led panel discussions on innovative practices to reduce water use and other crop inputs in order to safeguard Nebraska’s aquifer and surface waters.

The Nebraska Department of Transportation (NDOT) headed sessions to provide insight on how the State of Nebraska can support local governments in the pursuit of federal discretionary funds for broadband, roads, and bridges. NDOT’s launch of the Nebraska Infrastructure HUB aligns with Governor Pillen’s vision of increasing the state’s competitiveness for federal funding along with providing support to state and local partners in navigating the challenges involved with the application and administration processes. (Strimple, Laura and Urlis, Allan. Press Release. “Gov. Pillen Hosts ‘One Nebraska’ Ag and Economic Development Summit”. 09 August, 2024. https://shorturl.at/A2Uqz)

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

August 10th, 2024

Special session continued this past week. The Revenue Committee worked August 5th and 6th to go over the 68 bills we heard in public hearings to put together a package to bring to the floor. Many ideas have been presented and a lot of work has been done. Everyone has their own ideas and it is hard to get 49 Senators on board. This is still a work in progress, but it is a start. This is a spending issue, not a valuation issue.

There are three main goals behind the plan:

- Educate our children

- Encourage grandparents and families to stay in Nebraska

- Help businesses thrive

Since I have been in the legislature, property taxes have been discussed and addressed. Previous forms of property tax relief that have passed in past legislative sessions were the Property Tax Incentive Credit Act in 2020 with $395 million in relief; also introduced in 2020, LB1107 Income Tax Credit for property taxes paid with $560.7 million in relief; and in 2023 the Community College Future Fund Expenses with $246.5 million in relief. In total $1.202 billion was devoted to property tax relief before this special session.

On Thursday, August 8th, senators and their staff were invited to attend a briefing over the package being put together. The Revenue Committee decided to use Senator Jana Hughes’s LB9 as the main vehicle. LB9 utilizes additional state aid to public schools to lower the maximum levy cap in order to provide property tax relief for Nebraska property tax owners. Under LB9 the state will fund schools, county jails, district court clerks, and NRDs. Changes to LB9 are the levy lid taken down from $1.05 to $0.25 for fiscal year 2025-26 and following years and add language similar to LB1107 which allows for any excess revenue about 103% from the prior years’ collection to be put into the Education Future Fund for property tax relief.

On Thursday, August 8th, Governor Pillen said “I deeply appreciate the extremely hard work being done by the majority of the Legislature to deliver transformative property tax reform to Nebraskans. These senators, who represent all political stripes and all corners of our state, are doing right by their constituents by engaging in tough negotiations, good faith exchanges of ideas, and collaboration with their colleagues to forge a compromise that will work for Nebraska. Their dedication is even more impressive given that it is moving forward under intense pressure by lobbyists fighting to protect special interest loopholes at the expense of hardworking Nebraska homeowners. I know that any plan passed by the Legislature will be a hard-fought compromise and that it will not include every provision I believe in and am fighting for. Nevertheless, I have profound respect for the work of the Legislature and look forward to signing that work into law.” (Strimple, Laura and Urlis, Allan. Press Release. “Gov. Pillen Commends Senators’ Good Faith Work to Fix Nebraska’s Escalating Property Taxes; Condemns Political Intransigence”. 08 August, 2024. https://shorturl.at/60GgM)

New program being launched from the Nebraska Treasurer’s office

The Enable Savings Plan is ecstatic to inform you that we are launching a new, free-to-use crowdfunding website to work alongside your Enable Savings Plan account. Crowdfunding is a way to raise money by collecting donations from family, friends, friends of friends, strangers, and more (like GoFundMe or Kickstarter). This new website can be found at givetoenable.com.

We recognize that account owners may not have extra funds to save for disability related expenses and that sometimes emergencies occur that can put a tremendous burden on the account owner and their families. As a result, we have developed a new website called Give to Enable. This website is available for all Enable account owners and will allow them to raise additional funds to help cover their disability related expenses. Account owners would need to set up their own profile with a description of their crowdfunding needs.

This crowdfunding page is a separate website and you will need to set up an account to utilize this crowdfunding website.

How to Make an Account:

- Go to givetoenable.com

- Click on “Register” at the top of the screen.

- Fill in all the boxes and click “Sign Up” at the bottom.

- An email will go to an administrator, who will review your registration, and will contact you to let you know whether corrections need to be made or your account is approved and activated.

- You can then login and upload a picture, and your account should then show up on the website under “Members”.

- Feel free to share!

How to find your UGift code:

- Go to enablesavings.com

- Log into your account.

- Choose “View and Invite savings with Ugift” from the menu on the left side of the profile page.

- This will bring you to the Ugift page and you will see your six-digit alphanumeric code.

Want to Give?

- Go to givetoenable.com

- Click “Members” to read members’ stories, learn about their needs and decide who you would like to give to.

- Copy the member’s Ugift code found on their profile and click the link for ugiftable.com.

- Follow the instructions on the Ugift page to give.

- At the end of the process, there will be a confirmation page. Print that page and keep for your records.

- Using the Ugift code you contributed with, deduct the amount you gave on your Nebraska income taxes at the end of the year (up to $10,000 annually–$5,000 for married taxpayers filing separately).

If you have any questions, please email stacy.pfeifer@nebraska.gov.

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

August 2nd, 2024

This past week we had our first full week of Special Session. There were 81 legislative bills (LB) introduced and 24 legislative resolutions proposing constitutional amendments (LRCA) for a total of 105 bills, setting a record for number of bills introduced during a special session. Rule 9, which governs special sessions, indicated that all public hearings during a special session must be held within 5 calendar days after the date the bill, resolution, or gubernatorial appointment has been referred to the committee. Pursuant to this rule, committees had to complete their public hearings by Sunday, August 4th. The Revenue Committee had 68 bills referenced to them and we had to meet on Saturday in order to complete public hearings on all 68 bills.

Governor Pillen called this special session because he realizes this is a critical time for Nebraska and is bringing transformative property tax relief to all Nebraskans. This has been the number one issue in the state for the past 50 years and needs to be addressed now before it is too late. “Since the last legislative session, I have toured the state and held 26 townhalls to hear directly from Nebraskans. The message is clear, Nebraskans are struggling to balance a checkbook and continue to afford these tax increases,” said Governor Pillen. (Strimple, Laura and Urlis, Allan, 2024)

Over the past week we have listened to many ideas of how to address this issue including a bill on the EPIC option where there were only two opponents testifying in the hearing. We heard ways to address the issues with education funding where our main goal is taking care of teachers and educating our children. We are taking what we have learned in our committee hearings and are trying to enhance what Governor Pillen put in The Nebraska Plan to Cut Property Taxes, the Playbook. There is much more to come as we work together to address this important issue.

Monday and Tuesday the Revenue Committee, of which I am a member, regrouped and put together a package for consideration by the full Legislature. Wednesday, we convened at 1:00 p.m. and took up the gubernatorial confirmation reports that were advanced by their respective committees. Thursday, August 8th, debate begins on the property tax package from the Revenue Committee and the funding components from the Appropriations Committee. Late nights are scheduled for Thursday and Friday evenings with the potential to work a full day on Saturday.

News from the Governor’s Office

From July 15-24, Lieutenant Governor Joe Kelly and a 20-plus member team traveled to Indonesia for a trade mission. Indonesia is Southeast Asia’s largest economy, the world’s fourth-most populous country, and offers substantial market opportunities for Nebraska products. Indonesia is one of the top 10 export markets for Nebraska at $139 million and has a rapidly rising GDP (gross domestic product) and growing population. Top exports from Nebraska include soybeans/soybean meal, corn, wheat, and beef.

The group’s robust 10-day itinerary included meetings with the U. S. Grains Council, beef import associations and visits to a feed mill, a fueling station that utilizes ethanol and a tempeh factory. Tempeh is a very popular dish in Indonesia and representatives of the Nebraska Soybean Board said they were excited to explore opportunities to increase exports.

“Importers are very interested to know about how our products are grown and raised. They value family connections and sustainability–all things that are important in Nebraska agriculture–and makes our state a standout in the food products we have to offer,” said Lt. Gov. Kelly. With that in mind, he and Director Sherry Vinton from the Nebraska Department of Agriculture spoke frequently about the quality of family farming operations and the pride that goes into raising the best Nebraska products possible.

Lt. Gov. Kelly said all aspects of the trade mission were productive, with plenty of opportunities for Nebraska, considering Indonesia’s growing population of 270 million people.

“Nebraska helps to feed the world and their customers are demanding higher quality meat products, which is where we fit right in,” said Lt. Gov. Kelly. (Strimple, Laura and Urlis, Allan. Press Release. “Lt. Governor Kelly & Delegation Tout Opportunities from Trade Mission”. 31 July, 2024. https://shorturl.at/VZLhf)

Dakota Thurston County Fair

The Dakota Thurston County Fair Parade on Thursday, August 1st was a great success. It was so nice to have great weather to watch or participate in the parade. Turnout for the parade was incredible. Hats off to those who organized the parade and helped it run smoothly.

I was honored to stand with generations of Albrechts at the Extreme Bull Riding event on August 3rd as they received the Aksarben Farm Family Award, in partnership with the Nebraska Farm Bureau and the Nebraska Aksarben Association of Fair Managers, celebrating Nebraska’s agricultural heritage by awarding the Albrecht family with the Pioneer Award for owning land in Thurston County for 100 years.

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

July 31st, 2024

Governor Pillen called us back to Lincoln on July 24th with a proclamation for a special session on property taxes beginning on July 25th at 10:00 a.m. The first three days were spent introducing bills that fit into what the governor laid out in his proclamation. Public hearings began on Monday, July 29th. YOU are an important part of this process.

We here at the Legislature appreciate hearing all viewpoints on the bills that come before each committee. You are invited to participate in person or by submitting public comments online. Online written comments may be submitted for:

- Legislative Bills–go to nebraskalegislature.gov, proceed to Bills and Laws on the left side of the page, and enter the bill number.

- Amendments–via the calendar, once scheduled.

- Agency Hearings–via the calendar, once scheduled.

- Gubernatorial appointments–via the calendar, once scheduled.

- Second hearing on a bill–via the nebraskalegislature.gov and then select the bill number just as you did for legislative bills.

Steps for submitting public comment:

- Go to nebraskalegislature.gov and select ‘Bills and Laws’ on the left side of the page.

- Under ‘Bills and Laws’, click on “Search Bills”.

- Under Search Bills and Resolutions, enter your Legislative Bill (LB) number and click the search icon.

- Once you reach the bill page, under history, click on “submit comments online for LB”.

- Before submitting a comment there is a submission statement to read.

- The ability to submit written comments will become available when the LB has been scheduled for a hearing.

- To confirm your submission, a link from Nebraska Legislature with a subject line of Verify your Written Comment for LB# will be sent to the email you submitted. This step MUST be completed for EVERY comment submitted.

- Enter your written comment. There is a limit of 500 words.

The deadline to submit and verify a comment for the hearing record is the day of the hearing by 8:00 a.m. Central Time.

If you would like more information on how to be a part of the public hearing process, go to https://nebraskalegislature.gov/committees/public-input.php. I would encourage everyone to participate in the public hearing portion of the bill process by showing up in person or submitting a comment online.

Update on lawsuit on LB574–Let Them Grow Act

Friday, July 26th, the Nebraska Supreme Court ruled to uphold L. B. 574, the law that bans abortions at 12 weeks and gender-affirming care for minors. The law had been tied up in a legal battle after Planned Parenthood tried to block its enforcement earlier this year, claiming the bill violated the state’s single-subject rule.

The Nebraska Supreme Court wrote in its conclusion “After our review of the facts of this case and our historical legal precedent wherein we have rarely found violations of Nebraska Constitution article III, §14, we find no merit to Planned Parenthood’s argument that L. B. 574 contains more than one subject in violation of article III, §14. We affirm the decision of the district court.”

Governor Pillen weighed in shortly after the court’s ruling. “I am grateful for the court’s thorough and well-reasoned opinion upholding these important protections for life and children in Nebraska. I was honored to partner with faithful allies and leaders across the state to combine the abortion ban with protections for kids against irreversible sex change surgeries. We worked overtime to bring that bill to my desk, and I give thanks to God that I had the privilege to sign it into law. I immediately directed our state government agencies to swiftly bring these protections into effect.”

I am delighted with the ruling of the Nebraska Supreme Court. The challenge presented to the court was on children and health which falls under the title of the bill “Let Them Grow”. I am sorry so much time has been spent on LB574 as it went through the court system following its passing in 2023.

(Portions taken from Klinger, Sarah. (2024) “Nebraska Supreme Court upholds law banning abortion after 12 weeks, gender-affirming care for minors”. KETV Omaha [online] [Accessed 26 July, 2024] https://shorturl.at/qWA14)

As always, I invite you to let me know your thoughts, ideas, concerns, or suggestions by calling my office at (402) 471-2716 or emailing me at jalbrecht@leg.ne.gov.

Sen. Joni Albrecht

P.O. Box 94604

Lincoln, NE 68509

(402) 471-2716

Email: jalbrecht@leg.ne.gov

- Column (90)

- District Info (3)

- Press Releases (2)

- Uncategorized (223)

- Welcome (1)

-

Committee On Committees

Revenue

Transportation and Telecommunications

State-Tribal Relations

Streaming video provided by Nebraska Public Media