NEBRASKA LEGISLATURE

The official site of the Nebraska Unicameral Legislature

Sen. Tony Vargas

District 7

The content of these pages is developed and maintained by, and is the sole responsibility of, the individual senator's office and may not reflect the views of the Nebraska Legislature. Questions and comments about the content should be directed to the senator's office at tvargas@leg.ne.gov

March 7th, 2019

February 21st, 2019

Hello neighbors!

I have some fantastic news to share. Our little miracle Ava Kaye Vargas was born on February 14th (Valentine’s Day) at 5:11pm weighing 5 lbs, 10 oz. She came into our lives five weeks earlier than expected and was admitted to the NICU. Fortunately, Ava is a fighter and has made amazing progress. We are all settling in at home now as a new family of three.

I am forever thankful for my amazing wife, partner and best friend, Lauren, for bringing Ava into this world. We couldn’t have asked for a better Valentine’s Day present.

In addition to the birth of my daughter, our office also had a busy week. Last Wednesday my Legislative Aide, Meg Mandy, introduced two bills to the Revenue Committee on my behalf. The first is LB 310, which would set a timeline for the Department of Revenue to issue the Historic Tax Credit. This tax credit is used by developers to rehabilitate and revitalize historic buildings, benefiting both rural and urban areas communities across our state.

She also introduced LB 477, a bill that will provide a tax exemption for recipients of the Segal Americorps Education Award. Similar to the benefits provided by Pell Grants or under the G.I. Bill, the Americorps Education Award provides recipients with additional educational opportunities. However, unlike Pell Grants or the G.I. Bill, the Americorps Education Award is currently taxed. LB477 would change that, making sure that the folks who work tirelessly to better Nebraska are awarded in full for their service.

On Tuesday I introduced LB 550 to the Transportation Committee. LB 550 seeks to lower and eliminate some taxes and fees on wireless and prepaid wireless services. These taxes are regressive and unfairly impact consumers, resulting in Nebraska having the fourth highest state and local taxes in the country at 25.5%.

Next week I will introduce LB 51, a bill that allows Tesla to sell their vehicles in Nebraska for the first time. LB51 upholds free market principles and consumer choice by opening up the state to a brand new market that is both innovative and promotes clean energy. It has been a pleasure getting to know current and prospective Tesla owners across the state who are enthusiastic about the possibility of Nebraska moving further into the 21st century marketplace.

As always, please feel free to reach out to me at tvargas@leg.ne.gov or call my office at (402) 471-2721.

February 11th, 2019

In my two years in the Legislature, I have experienced how important it is to bring different perspectives to the table. Only through understanding the diverse array of viewpoints in our state can we, as legislators, attempt to solve problems that face all Nebraskans. Though we have made strides in recent years, our legislature still lacks much-needed diversity. One thing that makes it difficult for everyday people to serve in our citizen legislature is a constitutional barrier that sets senators’ salaries at $12,000 per year. This is why I introduced LR12CA, a resolution that would allow voters to amend our state constitution and raise the salaries of legislators to 50% of the median household income of Nebraska residents.

A 2017 survey done by the National Conference of State Legislatures found the average pay for state legislators to be $35,592 excluding per-diem and expense payments. At $12,000 per year, Nebraska falls far behind many states with similar costs-of-living, such as Arkansas, Michigan, and Iowa. When considering inflation, average legislator pay has decreased substantially over the past 30 years, especially in states like Nebraska which haven’t increased pay since 1989.

Higher legislative pay has several benefits. First, candidate recruitment becomes less difficult. Lawmakers and advocacy groups on both sides of the political aisle in Nebraska who once opposed increasing legislator pay now support it because they are struggling to recruit candidates. Second, it allows a broader range of citizens to consider running for office. Higher pay enables Nebraskans of all income-levels and in all districts to consider elected office.

Under LR12CA, legislator salaries would be adjusted every two years, at the beginning of each biennium. I felt it was important to set salaries this way so our salaries are responsive to Nebraska workers’ salaries. If their median income goes down, there is no reason our pay should stay higher. LR12CA’s method to determine legislator pay every two years has been tested in several states including Massachusetts and Pennsylvania. It’s an effective way to increase pay with respect to inflation and cost-of-living.

I am grateful that there is a bipartisan coalition of Senators who have co-sponsored this measure with me. These Senators represent a diverse coalition of political ideologies who together understand the necessity to make elected office more accessible for everyday Nebraskans. It is my hope that this measure will be adopted and put to the people of Nebraska for a vote.

January 31st, 2019

It is tough to find a better place in Nebraska to chow down than Downtown and South Omaha. Our district is home to a diverse array of dining options, representing the vibrant, multicultural community that we are. However, that diversity is not just present in the variety of foods, but also, in the dining experience. While our brick-and-mortar restaurants are some of the best in the state, we are also the home to some of the best food trucks in Nebraska. Unfortunately, today local municipalities and our state government have placed a patchwork of regulations on food trucks, making it difficult and costly for owners and operators to navigate and comply. This is why I introduced LB 732, a bill that my colleague Senator Carol Blood from Bellevue has cosponsored, that standardizes and streamlines permitting and inspections processes, encourages entrepreneurship, and maintains dining choices for consumers.

LB732 was created in partnership with the Omaha Food Truck Association, a group of local food trucks dedicated to serving Omahans a wide variety of cuisines from around the globe. I am grateful for their cooperation in creating common-sense legislation that maintains public safety and public health while bringing Nebraska up-to-speed with the rest of the nation.

Today, food trucks looking to operate in Omaha face different regulations and costs to do business than those that operate in Lincoln or Bellevue. The same food truck often operates in multiple cities, so these differences greatly impact their ability to conduct business and remain profitable. For instance, a permit to operate in Lincoln or Bellevue can be hundreds of dollars more expensive in Omaha. This can be too big of a hurdle for small business owners looking to get their feet off of the ground. This legislation will standardize the permitting process, setting the maximum fee that municipalities can charge at $75, in addition to a maximum of $40 health and safety inspection fee.

For consumers across the state, LB732 increases your opportunities to enjoy the food trucks that frequent Downtown and South Omaha. For example, this legislation ensures a city cannot place restrictions on hours of operation that are different than constraints on brick-and-mortar restaurants. In other words, a city cannot mandate that food trucks close at 2:30am, or what would otherwise be some of their peak business hours, leaving willing consumers without many options for some late-night grub. Additionally, LB732 grants food trucks the freedom to operate on public and private property, just like any other small business would have the authority to do.

It’s important to me that cities maintain some autonomy and aren’t completely constrained by regulations handed down by the state legislature. There are several provisions in LB732 that allow local governments to regulate food trucks to the extent that they would any other operating business. It is important that as the food truck industry continues to blossom, we do not limit its opportunities within our state.

All in all, it is my belief that food trucks all over the state will benefit when we streamline regulations and level the playing field for all operators. I am so excited for the opportunity to expand the vibrant dining scene in our district and across the state, with both brick-and-mortar restaurants and mobile businesses like food trucks.

January 24th, 2019

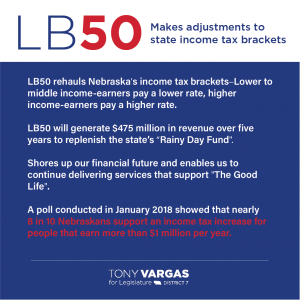

Yesterday I had the opportunity to introduce LB50 to the Revenue Committee. I want to take a moment to talk about why LB50 is a common-sense proposal to both promote economic fairness, as well as generate revenue for our “Rainy Day Fund.”

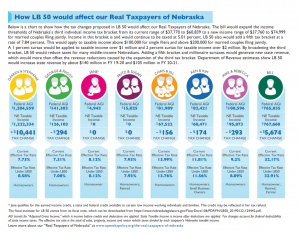

LB50 will rehaul Nebraska’s income tax brackets. Currently, everyone making more than $29,000 per year is taxed at the same rate of 6.84%. Under LB50, low and middle income-ea rners will be taxed at a lower rate. High income-earners will be taxed at a higher rate. People with incomes in excess of $1 million will pay an additional 1% in taxes and people with incomes of more than $2 million will pay an additional 2% in taxes. For more information about how this would affect people of different income levels, check out this helpful graphic from the OpenSky Policy Institute.

rners will be taxed at a lower rate. High income-earners will be taxed at a higher rate. People with incomes in excess of $1 million will pay an additional 1% in taxes and people with incomes of more than $2 million will pay an additional 2% in taxes. For more information about how this would affect people of different income levels, check out this helpful graphic from the OpenSky Policy Institute.

Over the past four years, Nebraska’s cash reserves, also known as our “Rainy Day Fund,” has been cut in half due to consistent downturns in projected revenue collected from state taxes. In addition, Nebraska’s population is rapidly aging and becoming increasingly urban. This massive demographic shift means that in our near future, there will be greater demands on services that can be harder to deliver in lower population areas.

LB50 will both generate revenue and ensure that our future generations have the same, if not more, opportunities than we do. Projected to increase revenue to the state by over $475 million over the next five years, LB50 will shore up our state’s financial future and enable us to continue delivering services that support “the Good Life.”

However, I am not the only one who is in favor of what LB50 would accomplish. In fact, a vast majority of Nebraskans are! A poll conducted in January of 2018 showed that nearly 8 in 10 Nebraskans support an income tax increase for people that earn more than $1 million per year. This is even broader support than Americans nationwide. A nationwide poll from January 12, 2019 shows 70% support for the same measure, including 56% of rural voters.

It is vital that as our state demographics continue to shift, and our cash reserves continue to deplete, we seek innovative ways to replenish our “Rainy Day Fund” and give ourselves room to grow. I am confident that should LB50 be adopted, it would have a tremendous positive impact on growing our state and ensuring its viability in the 21st century.

January 24th, 2019

Hello District 7!

Yesterday was the last day for bill introduction and this year I have introduced 26 bills. I spent the interim working with stakeholders in our district and across the state, and I am proud to share my legislative agenda with you. Here is a little more information about some of the legislation that I have introduced and how it will impact District 7:

LB 50 – LB50 will adjust state income tax brackets, lowering taxes on low and middle income earners and raising taxes on our state’s top earners — income over $1 million will be taxed an additional 1% and income over $2 million will be taxed at an additional 2%. I know well the struggles that working families in our communities are facing. LB50 evens the playing field a bit more by asking workers making more money to contribute more.

LB 310 – LB310 (reintroduced from 2017’s LB272) would expedite the process of receiving a Historic Tax Credit. This tax credit is used by developers to rehabilitate and revitalize historic buildings, benefiting both rural and urban areas communities across our state.

LB 687 – LB687 will make the process of registering to vote simpler and more accessible for all Nebraskans by allowing updates to your address at the DMV to automatically update your voter registration record. This makes registering to vote simpler for everyone while also increasing the accuracy of our voter rolls.

LB 723 – LB723 will lower the excise tax placed on our local breweries. I am thankful to the many who have reached out to me with concern regarding LB 314 & LB 497, two pieces of legislation that will raise the taxes on local Nebraska breweries. LB 723 is a viable alternative that honors the cultural and economic contributions that breweries make to our state. Breweries are important cornerstones in our communities — in urban areas like District 7 and in small towns like Ord, Broken Bow, and many more. We should do everything in our power to uplift this up-and-coming robust, vibrant industry.

LB 724 – LB724, or what my office refers to as the GIRL (Gender Inclusivity and Recognition of Leadership) Act, will require any corporation that wants to receive tax benefits under the Nebraska Advantage Act to have women compose at least least half of its board of directors. Study after study shows that when women are paid equally and given opportunities to advance both our economy and our families do better. For too long, Nebraska’s principles of fairness and equality have not been adequately extended to all those live or operate in our state. It’s time to put our money where our mouth is and ensure our tax dollars are used to properly incentivize companies that recognize the contributions of women and prioritize gender equity.

LB 732 – LB732 will streamline the permitting and inspection processes for food trucks. I was happy to work with the many food truck owner-operators from the Omaha area to craft legislation that makes it easier for them to operate across the state by removing some of the government red tape and standardizing permit fees and registration processes.

LB 737 – LB737 aims to provide a better picture of projects done using money from the Affordable Housing Trust Fund by changing reporting requirements. With the need for affordable housing rising in District 7, it is important to me to ensure these tax dollars are being used to effectively address this growing problem.

January 17th, 2019

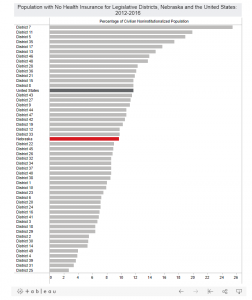

In 2018, Nebraskans expanded Medicaid, ensuring that more than 90,000 neighbors, family members, friends, and citizens across our great state receive access to the basic right of healthcare. Though the measure gained support in both rural and urban areas, Douglas County, and in particular, District 7, favored expansion by some of the widest margins in the state. I look forward to fulfilling my promise to fight for District 7 and ensuring that our community has access to affordable healthcare.

Our district has the highest rate of uninsured people of any in the state. For too long, healthcare costs have been too high and unaffordable. We have seen thousands of hardworking Nebraskans left behind by insurance companies, either unable to afford care or turned away for no fault of their own. Medicaid expansion will not only bring down the cost of healthcare, but will also provide 90,000 more Nebraskans with the safety, comfort, and dignity that comes with the basic right o f healthcare.

f healthcare.

As Nebraskans, we understand the importance of looking out for another and building strong bonds with our neighbors. I am so proud that our state took that next step, and now, it is the Legislature’s turn to fulfill their promise to Nebraskans. Though Governor Ricketts mentioned funding for Medicaid expansion in his State of the State address on Tuesday, as a member of the Appropriations Committee, I will fight to guarantee that Medicaid expansion is fully funded and recognized as the will of the people, and not at the expense of other critical programs like education and services for children and seniors.

In other news, I have dropped two more bills so far this week. LB 292 will help to fund the Microsoft Imagine Academy, a program designed to give students and teachers the training necessary to advance in a tech-driven economy. I also introduced LB 310, which would expedite the process of applying for a Historic Tax Credit. This tax credit benefits rural and urban communities alike, including District 7. The Historic Tax Credit program is crucial for ensuring that communities across our state maintain their beautiful histories.. Over the next few days, I will be introducing several more, so keep a lookout here!

January 17th, 2019

Last Wednesday marked the beginning of my second session representing District 7 in the Legislature. I am so excited to get back to work on behalf of the wonderful people of District 7.

On the first day of the legislative session, I was honored to be elected by my peers to serve as Vice Chair of the Executive Board, a role that will require the continuation of the bipartisan, consensus-forming approach that I have taken during my first two years in office.

Before discussing what my plans are for this legislative session, I want to take a moment to revisit all that we have accomplished in just two years. My work has been marked with a commitment to developing positive working relationships with Senators from every corner of our state and from a wide range of ideological perspectives. Together, we have been able to pass legislation and a budget that is fair to as many of our Nebraska neighbors and communities as possible.

I have been honored to serve on the Appropriations Committee under Chairman Stinner and Vice Chair Bolz, two great leaders, which has given me critical experience in having difficult conversations to resolve differences and find compromises to balance our budget and make smart investments for our future while best serving Nebraskans.

Last session, I introduced and unanimously passed my priority bill on payday lending reform, LB194. Working together with the Banking Committee and a bipartisan coalition of urban and rural senators, we came together around a common goal that is supported by nearly 90% of Nebraskans. Together we took a pragmatic approach to tackle this important issue and began to bring more economic fairness to working families in our communities.

My values driven and consensus seeking philosophy has also been demonstrated through my work as Vice Chair of the Legislature’s Planning Committee and as Co-Chair of the Juvenile Detention Alternatives Initiative, where I have worked together with stakeholders on common sense, evidence based, cost-efficient juvenile justice reform. Just last year we took a huge step in child welfare and passed my bill to end detention for children under the age of 12 for good with a supermajority vote.

We are currently in the process of introducing bills (you can keep an eye on introduced legislation here), and on the second day of the session, I introduced LB50 & LB51. LB50 is a bill that will adjust state income tax brackets, creating an additional bracket of 7.84% for those making more than $100,000, and levy an additional 1% tax for those making more than $1 million and 2% for those making more than $2 million. I have always been an advocate for economic fairness, and my goal with this bill is to alleviate the tax burden placed on low income and middle class families and more evenly place it on our state’s highest earners. LB51 upholds free market principles and consumer choice by allowing Tesla to sell their automobiles in Nebraska for the first time. Over the next eight days, I plan to introduce many more bills that are important to the people of District 7.

On a personal note, the next couple of months will become even more exciting as my wife, Lauren, and I welcome our first child in the spring. Though nerve-wracking, I am so grateful to be able to bring our baby girl into a community as wonderful, loving, and caring as District 7.

All the best,

Tony Vargas

January 24th, 2018

The 2018 legislative session is officially in full swing! This year I’ve introduced 19 bills, which is keeping my office very busy. My legislation this year spans topics from ensuring equal access to education for deaf and hard of hearing students to opening our state’s market to new and emerging businesses, and from reinforcing worker protections to restricting the use of juvenile detention. Below you can learn a little bit more about the bills I’ve introduced this year:

LB783 –

Reinforces and clarifies existing law that guarantees qualified education interpreters for deaf and hard of hearing students

LB784 –

Prohibits contractors and business with unpaid fines for violating the Employee Misclassification Act to the Department of Labor from entering into contracts with political subdivisions

LB785 –

Updates terminology in statutes relating to marriage to align with federal law

LB786 –

Modernizes language relating to elected and government officials

LB 826 –

Reaffirms and clarifies existing law that permits judges to make findings concerning the wellbeing of juveniles

LB 904 –

Closes a loophole that would allow payday lenders to obtain a new license as a credit service organization, which are intended to help improve a consumer’s credit

LB 922 –

Creates a new program that would extend health care benefits to all Nebraska children, regardless of immigration status

LB 974 –

Prohibits political affiliation, demographic information other than population figures, and results of previous elections from being considered in the drawing of legislative district boundaries

LB 999 –

Provides timelines and clarifications around student disciplinary actions and allows students to complete coursework during suspension or expulsion

LB 1074 –

Adjusts income tax bracket by lowering taxes on middle income earners and creating additional brackets for higher earners with increased rates of 1-3%. Increases the Earned Income Tax Credit from 10% to 12.5%, providing additional tax relief for low-income earners

LB 1082 –

Requires law enforcement agencies who enter into agreements to enforce federal immigration law to provide notice to the political subdivision and the public

LB 1101 –

Increases the reimbursement rate for short-term residential treatment, intensive outpatient treatment, and substance use assessment for behavioral health patients exiting correctional facilities

LB 1105 –

Changes the duration of a payday loan from a maximum of 34 days to a minimum of 34 days

LB 1110 –

Clarifies the intent of the Legislature to have public school and district scores reported annually

LB 1112 –

Restricts the use of juvenile detention and creates opportunity for alternative, community based resources

LB 1134 –

Expands upon federal law by requiring businesses who are closing or laying off more than 25 employees to notify the employees and the Nebraska Department of Labor at least 60 days in advance

LB 1135 –

Creates additional pathways to obtaining a Nebraska Teaching Certificate to address the shortage of full time and substitute teachers that exist across the state

LR295CA –

Increases Legislator salaries from $12,000 per year to 50% of the Census-reported median income, to be recalculated every two years

December 13th, 2017

Want to join my team here in the Legislature?

Applications for internships for the 2018 Legislative Session are now open in the following areas: social media, advocacy, and policy.

My office is willing to work with students to obtain class credit, if desired. Internships will begin on or before Wednesday, January 3, 2018, depending on the availability of selected interns.

Check out the job descriptions below and submit your application by Friday, December 15, 2017 to Brandon Langlois, Administrative Aide, at blanglois@leg.ne.gov. Read the rest of this entry »

Sen. Tony Vargas

P.O. Box 94604

Lincoln, NE 68509

(402) 471-2721

Email: tvargas@leg.ne.gov

- Column (2)

- Uncategorized (29)

- Welcome (1)

-

Appropriations

Committee On Committees

Executive Board

Reference

Planning

Streaming video provided by Nebraska Public Media