NEBRASKA LEGISLATURE

The official site of the Nebraska Unicameral Legislature

Sen. Megan Hunt

District 8

The content of these pages is developed and maintained by, and is the sole responsibility of, the individual senator's office and may not reflect the views of the Nebraska Legislature. Questions and comments about the content should be directed to the senator's office at mhunt@leg.ne.gov

January 3rd, 2024

Thank you for visiting my website. It is an honor to represent the people of the 8th legislative district in the Nebraska Unicameral Legislature.

You’ll find my contact information on the right side of this page, as well as a list of the bills I’ve introduced this session and the committees on which I serve. Please feel free to contact me and my staff about proposed legislation or any other issues you would like to address.

Sincerely,

Sen. Megan Hunt

March 14th, 2024

In 2023, the Heart Ministry Center interviewed 29 individuals who had been denied SNAP benefits due to a drug-related felony on their records. A sample of those interviews can be viewed here: https://youtu.be/Vfq_Q8HONjI?si=cAHTdQvluGXvlJ5C. 28 of the 29 interviewed had completed a drug treatment program but were still denied access to SNAP benefits.

“At the Center, we serve over 125,000 community members in our food pantry annually. The Center’s food distribution program is a “choice” food pantry, which means community members can choose what they want to eat. This allows clients to be treated with more dignity and respect while reducing waste. The Center’s food distribution program is the largest food pantry in Nebraska, and in 2023 the program distributed over 3.8 million pounds of food. The Center offers SNAP enrollment assistance as a part of our food distribution service and many are accessing this service because they do not qualify for SNAP due to their criminal records.”

— Heart Ministry Center

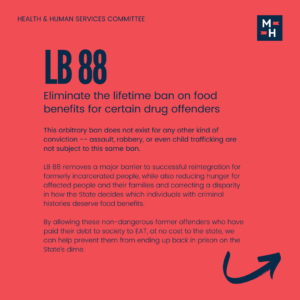

Under current statute, an individual with a conviction for drug distribution or with three or more felony convictions for possession or use of controlled substances is ineligible to receive SNAP benefits for the rest of their life. LB 88 would allow these individuals to become eligible for SNAP once they have either completed their sentence or they are serving a term of parole, probation, or post-release supervision.

This ban is selectively moralistic, and incongruent when we consider that it doesn’t apply for any other type of crime. It’s cruel and willfully ignorant to say that our prison systems are intended to be rehabilitative, and for us to then send these folks back out into the world and continue punishing them by denying them access to assistance in meeting one of their most fundamental needs.

This bill has been brought many times, and I will continue to bring it until it is passed or until my time in this body is over.

When people are re-entering society after time in a correctional facility, their first and most basic human need is food. For many, it takes time to get established with housing, a career, and to start rebuilding a productive life. None of that can happen for a person that is going hungry.

Dear friends and neighbors,

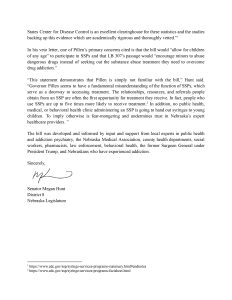

Despite the broad bipartisan support and the bill’s data-backed approach, today Governor Pillen has vetoed my priority bill, LB 307. In response, I want to express my disappointment and reiterate the importance of this public health measure for Nebraska prior to the Legislature taking up a veto override in the coming days.

Governor Pillen’s veto statement about my priority bill demonstrates that he is simply not familiar with the bill. He has a fundamental misunderstanding of the function of Syringe Service Programs (SSPs), which serve as a doorway to accessing treatment. The relationships, resources, and referrals people obtain from an SSP are often the first opportunity for treatment they receive. In fact, people who use SSPs are up to five times more likely to receive treatment. In addition, no public health, medical, or behavioral health clinic administering an SSP is going to hand out syringes to young children. To imply otherwise is fear-mongering and undermines trust in Nebraska’s expert healthcare providers.

The bill was developed and informed by input and support from local experts in public health and addiction psychiatry, the Nebraska Medical Association, county health departments, social workers, pharmacists, law enforcement, behavioral health, the former Surgeon General under President Trump, and Nebraskans who have experienced addiction. I have no doubt that we will successfully override this veto and make great strides toward our shared goals of increasing public health and safety through LB 307.

Below you can read my press release in response to Governor Pillen’s veto.

I appreciate your ongoing support and engagement on matters vital to our community’s well-being. Stay tuned for updates on LB 307 and other initiatives aimed at building a healthier Nebraska.

All the best,

Meg

January 4th, 2024

Dear friends and neighbors,

As we step into this new legislative session, I am filled with hope and determination to enact positive change for our community. Our unwavering focus remains on championing bills that promote equity, ensure housing stability, and remove discriminatory barriers. Together, our collective efforts will ensure our state thrives by uplifting every individual and family.

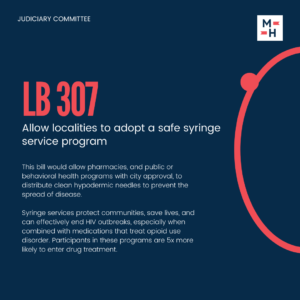

Yesterday I prioritized LB307, which would empower local jurisdictions to authorize public health programs to distribute hypodermic needles as part of public health efforts to reduce the spread of infectious diseases such as HIV and Hepatitis C.

I also introduced two bills to protect students facing eviction during the school year (LB845) and to reduce the prevalence of bed bugs and evictions (LB846). Today, I introduced LB913, a bill to extend postpartum care to all women and people who need it.

This year, my primary focus is continuing the work on bills I introduced last year, which carry over into this new session. You can view the full list of bills I have introduced since last session here. These bills encapsulate our shared vision for a better state.

I’m looking forward to a legislative session that prioritizes things that improve the lives of all Nebraskans like workforce, housing, and attracting and retaining talent, rather than targeting groups that are already marginalized or struggling. Let’s use these 59 days to do good.

All the best,

Meg

Priority Bill – LB307

As I mentioned, I am designating LB307 as my personal priority bill for this year. It was my priority bill last year but was not scheduled for debate. It remains on General File and is in a good position to see early debate with bipartisan support this year.

LB 307 would allow local jurisdictions to authorize public or behavioral health programs to distribute hypodermic needles as part of public health efforts to reduce the spread of infectious diseases such as HIV and Hepatitis C. Such programs are known as Syringe Service Programs (SSPs). SSPs protect the public and first responders by facilitating the safe use and disposal of syringes; curbing outbreaks of disease; and encouraging intravenous drug users facing addiction to access treatment.

Nebraska’s HIV infection rate has shown an alarming trend in the years since the pandemic: 2021 saw the highest number of new infections in more than a decade, a figure largely driven by an uptick in rural counties’ infection rates. As fentanyl prices drop and more of the drug is trafficked, fentanyl overdose incidents are on the rise. 214 Nebraskans died of overdose in 2021. SSPs can help address each of these issues by providing comprehensive services such as fentanyl test strips, overdose prevention education, and referrals to substance abuse treatment programs. SSPs are proven to reduce the incidence of HIV, hepatitis C, and other bloodborne diseases by as much as 50%, and SSP participants are five times more likely to enter treatment and engage in long-term recovery than users who do not use an SSP.

Under current Nebraska law, a local jurisdiction that wishes to authorize an SSP is prohibited from doing so by the Uniform Controlled Substances Act. With LB 307, the legislature could grant localities a powerful tool to exercise local control and the discretion to meet their community’s needs as they see fit. In a rural community, there might not be any good option for a brick-and-mortar location that could house an SSP. In those places, the community could implement the program through their local pharmacy, or do something more innovative like a mobile service unit. With LB 307 we leave that up to the local jurisdiction, who can set the parameters for their particular program. The bill does not require any locality to adopt such a program.

The Committee Amendment (AM381) was suggested by expert physicians with the Nebraska Medical Association, who encouraged us to provide some legal protection for program participants. If an intravenous drug user is trying to do the right thing by using more safely through an SSP and potentially seeking resources to help overcome their addiction, we do not want to criminalize them. AM 381 shields users from criminal liability related to their use of SSP services, which could be a major deterrent to anyone who would otherwise want to use an SSP. There is no cost to the state associated with LB 307. When we consider that the average lifetime cost of treating a person living with HIV is somewhere around $420,000, this is a preventive measure that can provide significant cost savings to the State. Additionally, there may be funding available to fund SSPs through the federal Substance Abuse and Mental Health Service Administration (SAMHSA) or the Opioid Settlement Fund.

This bill came out of committee with 7 yes votes, not a single no vote, and has bipartisan support from the Douglas County Sheriff, Nebraska Medical Association, The R Street Institute (a conservative, free-market think tank), the Nebraska AIDS Project, Centerpointe, the Nebraska Association of Behavioral Health Organizations, and OutNebraska. My office is working to solidify official support from public health directors, the UNMC College of Public Health, NACO, and the League of Municipalities in advance of the debate.

District 8 Events

Christmas Tree Disposal

- Sites close on Jan. 9th

- Click here for a full list of locations and requirements

- Jan. 5th, starting at 5pm

Folk House Concerts at the Castle

- Jan. 12th at Joslyn Castle Carriage House

- Jan. 13th at Culxr House at 7pm (tickets $20)

Gender Fluids by Big Canvas Comedy

- Jan. 19th at Blackstone Theater at 8:30pm (tickets $10)

- Comics from across the gender spectrum showcase their comedy skills

- St. Cecilia Cathedral on Jan. 26th, 27th, and 28th

- July 27th and 28th

Our Office in the News

Omaha World-Herald – Nebraska Legislature kicks off 2024 with multiple workforce development bills

KETV Omaha – 2024 means $12 minimum wage in Nebraska, but no change for tipped employees

News Channel Nebraska – No shortage of critics for Pillen’s suggested sales tax hike

Lincoln Journal Star – Ernie Chambers, others plead for Pillen to accept summer food aid for Nebraska children

KETV Omaha – Nebraska Legislature focused on property tax relief, and workforce solutions in 2024

Lincoln Journal Star – League of Women Voters of Nebraska files amicus brief in Planned Parenthood case

October 10th, 2023

It’s that time of year again. My office is looking for a few great students to intern with our office!

Apply here by Nov. 13th! More details are below.

Position: Legislative Intern

Location: Nebraska State Capitol, Lincoln, NE

Duration: January 2024 – May 2024 (Flexible start and end dates)

Compensation: Unpaid (Academic credit available)

About Senator Megan Hunt: Senator Megan Hunt is a dedicated advocate for the people of Nebraska, known for her progressive approach to policy-making and her commitment to community engagement. Elected in 2018 and re-elected in 2022, Senator Hunt serves on several key committees, focusing on issues such as education, healthcare, and workforce development. You can view more information about Senator Hunt here: https://nebraskalegislature.gov/senators/landing-pages/index.php?District=8

Internship Description: As an intern in Senator Megan Hunt’s office, you will have the opportunity to gain firsthand experience in the legislative process and contribute to meaningful policy initiatives. This internship offers a unique insight into the inner workings of Nebraska’s legislative system and provides an invaluable learning experience for individuals passionate about public service.

Responsibilities:

- Ability to work 5-10 hours/week (flexible)

- Conduct research on legislative issues, policy proposals, and constituent concerns

- Draft memos, reports, and other written materials

- Attend committee meetings, hearings, and community events on behalf of the office

- Assist with constituent inquiries and correspondence

- Support the legislative team with administrative tasks

- Create social media graphics and content on legislative issues

Qualifications:

- Enrolled in an undergraduate or graduate program

- Strong written and verbal communication skills

- Analytical and research-oriented mindset

- Ability to work independently and collaboratively in a fast-paced environment

- Commitment to maintaining confidentiality and handling sensitive information with discretion

How to Apply: Interested candidates should submit this form. The form will ask for:

- Three responses to relevant questions

- Resume

- Cover letter outlining your interest in the internship and relevant qualifications

- Contact information for one reference

Application Deadline: Monday, November 13th by 11:59pm CT.

Application Decision: You will be notified about your application by Monday, November 27th.

Note: This internship may be eligible for academic credit. Please check with your academic advisor or institution for specific requirements.

Senator Megan Hunt’s office is committed to creating an inclusive and diverse work environment. Individuals of all backgrounds are encouraged to apply.

For further inquiries, please contact Cassy Ross at cross@leg.ne.gov

We look forward to welcoming a passionate and dedicated intern to our team for the 2024 legislative session!

July 27th, 2023

My colleagues and I have urged Nebraska Attorney General Mike Hilgers to clarify his stance on reproductive healthcare privacy and medical autonomy, in response the to AG’s recent efforts to oppose the Department of Health and Human Services HIPPA Privacy Rule that would protect patients.

Read our full letter below that address our crucial concerns over access to medical records and the prosecution of patients and healthcare providers. Contact Attorney General Hilgers’ office at (402) 471-2683 to urge him to uphold our right to privacy.

Dear friends and neighbors,

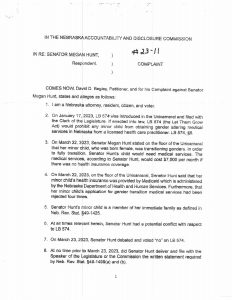

Today I was informed by the Nebraska Accountability and Disclosure Commission (NADC) that because of a complaint filed by David Begley, I am under official investigation for a conflict of interest for having a trans child and voting against LB574. My colleagues stood up offering me their kind words and disapproval of this complaint.

I don’t need their words. I need their vote. My child needs their vote. Children and families from across our state need their votes. Words are meaningless unless you put action behind them. I will continue to advocate for our children – yours, theirs, and mine – no matter what harassment or intimidation comes my way.

All the best,

Meg

This is using the legal system that we have in our state to stop corruption, to increase transparency, and to hold governments accountable and instead use it to harass a member of the Legislature. You can view my comments on this blatant harassment here.

February 2nd, 2023

Dear friends and neighbors,

LB 574, a bill that would prohibit healthcare providers from providing gender-affirming care to children, will be heard in the Health and Human Services Committee on February 8th.

Children’s Hospital, an organization that has previously been so vocal in supporting LGBTQIA+ kids, has decided to take no position on the bill. Please consider signing and sharing this letter asking Children to stand up for trans kids on February 8th and always!

You can also read the bill AND submit online testimony (SUPER IMPORTANT!!) Click here to ensure your voice is heard! The deadline to submit and verify a comment for the record is February 7th at 12:00 pm.

All the best,

Meg

Testify in Opposition to the LB574

Feb. 8th at 1:30 pm

Room 1510

Health & Human Services Committee

Committee members include Senators: Hansen (chair), Hardin (vice-chair), Ballard, Cavanaugh, M., Day, Riepe, and Walz.

|

|

|

|

|

|

|

|

|

|

|

|

|

January 9th, 2023

Dear friends and neighbors,

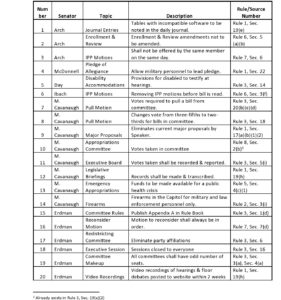

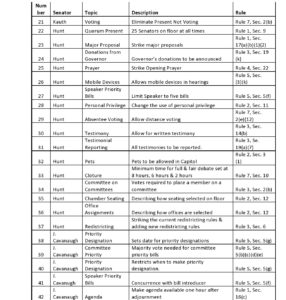

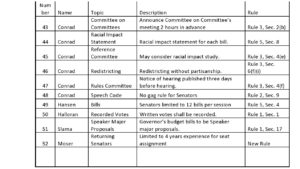

At the start of each biennium, before the Legislature can begin our work to address issues to move our state forward, we must first agree upon internal rules to govern our legislative session. This is a point of contention this year, as the new conservative supermajority has signaled their intentions to alter our rules to sway the balance of power further in their favor and remove the nonpartisan safeguards we have had in place since the inception of the Unicameral. As a defender of our institution, above all else, I am committed to upholding our norms, rules, and procedures – but I need your help.

The public hearing on proposed internal Legislative rule changes has been scheduled for Thursday, at 1:30 pm in Room 1525 of the Capitol. As Nebraska’s Second House, we need to hear from you. If you can, come testify during the rules hearing and ensure lawmakers hear directly from you that you value our unique nonpartisan institution – and that the public deserves more notice and involvement in this process.

There are 52 proposals on the table that have been submitted to the committee. Among them are measures that threaten to eliminate the political balance on the redistricting committee; to make committee executive sessions closed to the media; to change the balance of members on committees; and an arbitrary cap on the amount of bills senators can introduce. One of those measures I’m most concerned about is a proposal that would do away with our 86-year tradition of using “secret ballots” to elect committee leaders. This process has been used since the unicameral was created in order to eliminate partisan pressure on senators and allow them to anonymously make decisions about who is the best person to lead a committee. These efforts are a clear, direct attack on our institution, our unique method of lawmaking, and our long-held traditions.

Don’t be fooled, these attacks won’t stop here. We need your help to protect the nonpartisanship of the Legislature. I hope to see you testifying in room 1525 on Thursday.

All the best,

Meg

Come Testify!

Thursday, January 12th

1:30 pm

Room 1525, State Capitol

List of Proposed Rule Changes

The list includes the top line of each of the 52 proposed rule changes that will be discussed this session. A more detailed list, containing exact wording will be released soon.

Sen. Megan Hunt

P.O. Box 94604

Lincoln, NE 68509

(402) 471-2722

Email: mhunt@leg.ne.gov

- Column (47)

- District Info (4)

- Events (6)

- Opinion (2)

- Press Releases (24)

- Uncategorized (7)

- Welcome (1)

-

Business and Labor

Committee On Committees

Government

Military and Veterans Affairs

Urban Affairs

State-Tribal Relations

Streaming video provided by Nebraska Public Media