NEBRASKA LEGISLATURE

The official site of the Nebraska Unicameral Legislature

Sen. Steve Erdman

District 47

The content of these pages is developed and maintained by, and is the sole responsibility of, the individual senator's office and may not reflect the views of the Nebraska Legislature. Questions and comments about the content should be directed to the senator's office at serdman@leg.ne.gov

March 31st, 2023

Property tax relief has always been my number one priority in the State Legislature. Last Friday the State Legislature began debate on the Revenue Committee’s primary property tax relief bill for 2023. Although LB 243 was introduced by Sen. Tom Briese of Albion, the Revenue Committee adopted his bill as a committee priority bill and amended several other bills into it, including one of my bills. So, today I would like to tell you about what the Legislature is currently doing to provide all Nebraskans with some much-needed property tax relief.

LB 243 increases funding for the Property Tax Credit Fund from $275 million to $388 million in 2024 and $428 million in 2025. The fund will increase incrementally until it finally reaches $560 million in 2029. The bill also requires revenue in the fund to grow over time in proportion to the overall statewide increase in assessed property values. Without this provision in the bill property tax relief would slowly diminish over time.

LB 28 is one of my bills which was amended into LB 243. LB 28 reforms the way that the Tax Equalization and Review Commission (TERC) conducts their business. TERC has been backlogged with appeals. I know one landowner who just received notice of a hearing for an appeal he filed in 2013! No one should ever have to wait ten years to get a hearing. Moreover, no one should have to pay property taxes for ten years based upon a wrongful and erroneous assessment of their property. Therefore, my bill reverts the assessed value of the property to the previous year’s value until TERC makes a decision.

An amendment that I filed would help TERC get caught up on their backlogged cases. The amendment would add another member to the commission, tie the salaries of the commissioners to eighty five percent of the salaries of the supreme court justices for presiding officers and seventy five percent for non-presiding officers, and increase the cap on cases which can be reviewed by a single commissioner. Currently, properties that are valued at less than one million dollars may be reviewed by a single commissioner. My amendment would raise that cap to two million dollars in order to help expand the number of hearings that could be held each year.

Another bill by Sen. Tom Briese which was amended into the Revenue Committee’s priority bill was LB 242. This bill would raise the amount of allowable funding for the Nebraska Property Tax Incentive Act to one billion dollars. Currently, funding for this income tax credit is limited to a five percent cap on the annual allowable growth percentage. The bill would remove this five percent cap so that the property tax relief created by this Act would be able to increase at the same pace as the annual growth percentage.

LB 309 by Sen. Eliot Bostar of Lincoln was also amended into the Revenue Committee’s property tax relief bill. This bill raises the interest rate from nine percent to fourteen percent for unpaid balances owed to taxpayers by political subdivisions. This would match the interest rate that taxpayers have to pay to political subdivisions when they are late in paying their taxes.

LB 589 is another bill by Sen. Tom Briese which was amended into the bill. This bill would put a cap of three percent on a school district’s revenue growth. However, the school board could override the three percent cap with a vote of seventy percent of the school board members or by sixty percent of the voters at a levy override election.

A final bill by Sen. Dave Murman, LB 783, completes the Revenue Committee’s Christmas Tree bill for property tax relief. This bill removes the levy authority of the community colleges beginning in the year 2025. Although the community colleges would lose their levy authority, it would be restored in the event that the State could not fully fund the colleges.

While the Revenue Committee’s property tax relief bill will provide taxpayers with some much-needed property tax relief, it does not fix our State’s broken tax system. To make an analogy, each of these property tax relief bills is like putting a band-aid on an amputation. These fixes won’t stop the profuse bleeding. Instead, I continue to believe that the only way to truly fix our broken tax system is to adopt the EPIC Option Consumption Tax. If you have not already done so yet, please visit our website at www.epicoption.org.

March 24th, 2023

Life in the Unicameral Legislature is always full of surprises. Last week I saw things I thought I would never see. The structure of the Unicameral Legislature is such that it allows for a single State Senator or a minority group of State Senators to control how the debate on a bill proceeds on the floor. So, today I would like to tell you about what has been happening at the Capitol in Lincoln and how I intend to fix it.

Sen. Machalea Cavanaugh of Omaha has effectively derailed the first half of the Legislative session for this year by leading a series of filibusters on bills that have come up on the floor for debate. Because a filibuster takes eight hours to complete, she has managed to waste a lot of precious time which could have been spent debating other bills. However, everything finally came to head last week once the Legislature advanced LB 574, otherwise known as the Let Them Grow Act, which prohibits those in the medical field from administering gender altering drugs and procedures to minors.

Democrats in the Unicameral Legislature have begun using a new stall tactic. By rule, priority motions always take precedence over amendments in the State Legislature, and the Senator making the motion always gets ten minutes at the microphone to open on the priority motion. Therefore, a small group of Democrat Senators began to make priority motions on bills and withdrawing the motion at the end of their ten-minute opening. At that point one of their colleagues would introduce a new priority motion, which would take another ten minutes off the clock. This would go on and on so that Republican Senators would never get an opportunity to speak on the bill.

Many of the State Senators who have engaged in this stall tactic are the same ones who have been the most vocal when it comes to praising the Unicameral Legislature for being a non-partisan Legislature, who make demands for congeniality, who pretend they want everyone to get along, and who supposedly value giving everyone the opportunity to speak. So, on one particular occasion last week they put 15 bracket motions on a single bill, withdrew the motions after ten minutes, and effectively denied 30 Republican Senators of their opportunity to participate in the floor debate.

I do not intend to let these stall tactics go on any longer. So, at the end of Friday’s floor debate, I introduced a motion of my own. My motion will ask the Legislature next week to temporarily suspend the rules in order to make an important rule change for the remainder of the 108th Legislature. That rule change entails that a motion to bracket a bill, a motion to indefinitely postpone a bill, and a motion to recommit a bill may only be made once on a single bill on the same day that it gets debated on the floor of the Legislature.

This rule change would effectively end the stall tactics of those State Senators who do not want to engage in a full and fair debate on a number of bills they do not like this year. LB 574 was only the second of several controversial bills which stand to receive a debate on the floor of the Unicameral Legislature this year. LB 77 was the first. LB 77 would allow all Nebraskans to conceal and carry a firearm without a permit. In addition, the State Legislature may also have the opportunity to debate LB 575, the Sports and Spaces Act, which would prohibit boys from participating in girls’ sports, LB 626, the Heartbeat Act, which would limit abortions to the sixth week or pregnancy, LB371, a bill prohibiting minors from attending drag shows, and LB 441, a bill that repeals an exemption for educators who provide minors with obscene materials.

Whether or not you support any of these controversial bills is not at issue here. All bills deserve to receive a full and fair debate on the floor of the Unicameral Legislature without dilatory motions derailing that process. Many bills have come up to the floor of the Legislature for debate that I have not liked, but derailing the entire legislative calendar was never something that I ever gave any serious consideration to. Unless we do something drastic and soon, we stand to lose the entire second half of this year’s legislative session.

March 16th, 2023

One of the bills that I co-signed this year is LB 712. LB 712 was introduced by Sen. Brian Hardin of Gering. This bill is important because it would help with the needs of the Panhandle once they add an additional 3,000 people to the workforce for a new ballistic missile upgrading project. Seldom does the Panhandle ever get to be the recipient of legislation that would significantly benefit the economy of the Panhandle and this bill would do just that.

LB 712 appropriates $26 million to the Ground Based Strategic Deterrent Deployment Fund. The fund would be placed under the care of the Adjutant General and would be used for grants to support the City of Kimball and its outlying areas to address deficiencies in community infrastructure, transportation, healthcare facilities, law enforcement and emergency response, recreation, and workforce development in order to support the Ground Based Strategic Deterrent Deployment and Minuteman III Decommissioning and Disposal Accommodation project if the State of Nebraska is selected as the site for the headquarters.

Earlier this month Gov. Jim Pillen wrote an article whereby he explained his reasoning for not including state funding for communities associated with the updating of this intercontinental ballistic missile project in his budget for this year. According to Gov. Pillen, all of the necessary funding for this project would come from the federal government, the project would be completely self-sufficient, and those contract workers who would be imported from the Gulf of Mexico to do the work would be confined to the secured area.

When we asked Northrop Grumman, the contractor who would be doing the missile upgrading work, if they would be using local utilities or infrastructure to support their work, we got a different response. While the secured workforce hub would have the ability to be completely self-sufficient, Northrup Grumman admitted to us that the contractor “may choose to use local utilities.”

When asked if the workers would be confined to the secured area of the workforce hub, we also received a different response. According to Northrup Grumman, they have “current plans for weekend busses to bring some of the workforce into various towns in the region to shop, see a movie, grab a bite to eat, attend church, etc.” We also learned that ten to twenty percent of the workforce needed to complete the work would come from local communities.

Unfortunately, Gov. Pillen received some very bad information. While nothing in LB 712 appropriates funds for the upgrading of ballistic missiles it does appropriate monies to the City of Kimball and its outlying areas to accommodate for the influx of workers moving into and visiting the area, and that is why this bill is so important.

Without the revenues provided by LB 712 the City of Kimball would have to go it alone. Last year the City of Kimball bonded $2.3 million to upgrade its power generation system and they also have a need to upgrade their wastewater plant which would cost the city another $ 5 million. Last week the city council voted to add a half cent sales tax onto the ballot for a special election to be held in June. The City of Kimball is doing all that it can to service the needs of these contract workers and to support the local communities in the outlying areas.

Despite the Governor’s lack of support for the economies of Western Nebraska, especially as folks in the Panhandle gear up for this ballistic missile upgrading project, the Nebraska Legislature could be bringing some financial relief. The day after Gov. Pillen published his article against LB 712, the Government Military and Veterans Affairs Committee of the Nebraska Legislature advanced the bill to General File.

The Governor has stated that the State would take care of the City of Kimball if needed. The Governor can only spend a limited amount of money without approval from the Legislature. Therefore, those of us in the Legislature must appropriate the funding contained in LB 712, so that the State can help the Panhandle once this project gets approved.

I want to thank Sen. Hardin for his foresight and leadership on this very important bill.

March 10th, 2023

On March 3 the Revenue Committee of the Nebraska Legislature held a public hearing on my priority bill, LB 79, which explains the distribution of the EPIC Option Consumption Tax. The hearing was highly successful with proponents outnumbering opponents by a ratio of three to one. Also included in the hearing were two accompanying resolutions for constitutional amendments, LR6CA and LR7CA. Because I have not written very much on the EPIC Option Consumption Tax yet this year, today I would like to address some of the misconceptions and objections about the EPIC Option Consumption Tax.

There are many misconceptions of the EPIC Option Consumption Tax. One of the misconceptions I have been hearing about is that it takes away local control of the budgeting process. Nothing could be further from the truth. The EPIC Option Consumption Tax actually preserves local control of the budgeting process. The best local control is when you have control over how much you pay in taxes. That’s local control! What my bill takes away from local units of government (LUGS) is their right to tax you into oblivion.

Last summer we held an interim study to explore how best to resolve the distribution problem to the LUGS. I had help from a variety of sources, including county commissioners, city council members, NRD board members, and school superintendents. Together we set out to create a model that would preserve local control of the budgeting process when funding comes from the state. The result of that interim study became LB 79. This distribution model is very similar to how Nebraska used to govern the budgeting process prior to 1967.

Another objection to the EPIC Option Consumption Tax relates to the rate. According to the dynamic study prepared last month by the Beacon Hill Institute, Nebraska could implement the EPIC Option Consumption Tax at a rate as low as 7.23 percent. My bill, LB 79, sets the rate initially at 7.5 percent. The reason I did this was to create a cushion for the State. Setting the rate at 7.5 percent would generate an extra $100 million buffer for the State. Having that buffer for the first year is simply wise.

Despite these findings by the Beacon Hill Institute, many have suggested that the EPIC Option Consumption Tax would require a much higher rate. Nearly everyone I know who has ever made this claim relies upon an old study that was conducted three years ago by the Open Sky Institute in conjunction with the Institute on Taxation and Economic Policy (ITEP). That study is fallacious for three reasons: The study was conducted on an old model, the study was a static study and not a dynamic study, and the study failed to take into consideration the elimination of all sales tax exemptions.

The math of the ITEP study was simply wrong. The ITEP study used a consumption tax base of $55 billion to get a rate of 22 percent. Instead, they should have calculated the current sales tax base at $49 billion, then added $61 billion in sales tax exemptions, then add another $24 billion in economic growth for a total consumption tax base of $134 billion. That is how we got the 7.23 percent tax rate.

Some have complained that the EPIC Option Consumption Tax is regressive and would unfairly harm the poor, causing them to make hard decisions with their money. The EPIC Option Consumption Tax does less harm to those on a fixed income than the current sales tax because it imposes no taxes on used goods. It is the poor who are more likely to purchase used goods and the EPIC Option Consumption Tax imposes no taxes on used goods.

Finally, some people complain that the EPIC Option Consumption Tax would allow cities and counties to impose their own consumption taxes on top of the state-imposed consumption tax. While the bill does allow for cities and counties to impose their own consumption taxes, it needs to be pointed out that this is no different than what currently happens with the sales tax.

If you would like to know more about the EPIC Option Consumption Tax, then please visit our website at www.epicoption.org.

March 3rd, 2023

In 2022 the voters of Nebraska passed ballot initiative 432 to amend the Nebraska State Constitution to require voters to show photographic identification when voting. That ballot measure passed by a vote of 432,028 in favor to 228,031 against. So, the measure passed by a two-thirds margin of the voters.

That ballot initiative also directed the State Legislature to pass laws for the implementation of voting with a photographic identification. So, this year I introduced LB 228 and LB 230 while Sen. Jen Day of Omaha introduced LB 675. Last Wednesday a public hearing was held on these three bills, so today I would like to report on how that hearing went and give you an update on what needs to be done.

More than two-thirds of those who testified online and in person supported my two bills. 250 people supported LB228 out of a total of 366 testifiers, while 243 people supported LB 230 out of a total of 352 testifiers. Sen. Day’s bill, LB 675, received much less support.

One important aspect of LB 228 is that it would bring ballot counting back down to the precinct level. Counting ballots at the precinct level is how we used to do it, and I believe we need to go back to that method. LB 228 does not specifically call for a hand count of paper ballots at the precinct level; instead, it gives counties the option to count ballots by hand or by machine at the precinct level. Because machines can be expensive, especially for each precinct, counties should not be burdened with having to pay for a machine they may not want.

My other bill, LB 230, is a more comprehensive bill on voting with photographic identification. The bill defines a qualified voter as well as what constitutes a qualifying photographic ID for voting purposes. The bill would require those voting with a provisional ballot to present their photographic identification at the county election office by the following Thursday in order for their vote to be counted.

The bill allows for early voting by mail for military personnel, including those in the National Guard. Military personnel and members of the National Guard would sign an oath on their application swearing that they are a member of a branch of the military or are enlisted in the National Guard. Along with the application, a voter in the military would submit a color copy of his or her photographic identification.

LB 230 also allows for early voting by mail for those who have been diagnosed by a physician to be physically incapacitated. Current State Laws, especially 32-944, already allow for nursing home workers and hospital workers to act on behalf of the county clerk in administering ballots to their residents. My legislation would add those living in assisted living facilities to the list of those who could vote early by mail.

LB 230 further specifies that an agent delivering a ballot to a registered voter would have to pick up the ballot at least one hour prior to the closing of the polls and return the ballot with a color copy of the registered voter’s photographic identification by the time the polls close on election day. This is an important part of the bill, because it shows how those who might otherwise be confined to their home or who are unable to get to the polls could still cast their vote on election day.

February 24th, 2023

Although I have been a Nebraska State Senator for the past six years, I had never introduced a bill that was referenced to the Judiciary Committee until this year. This year I introduced LB 394 which had a public hearing last week before the Judiciary Committee, so today I would like to tell you about that bill.

LB 394 is a bill that changes our laws about eminent domain. Eminent domain is the law which allows governmental entities to seize private lands for public use. Currently, Nebraska’s laws for eminent domain favor those governmental entities which use eminent domain and discriminate against those landowners who do not want the government to take their lands away from them. My bill institutes fairness in the way that eminent domain is used for taking private property in our state.

Agricultural lands differ from residential properties in that agricultural lands are used to generate income for the landowner. Because agricultural lands represent the bread-and-butter income for those who own them, the future loss of income to the farmer or the rancher needs to be taken into consideration when valuing these properties for eminent domain. Current law says that properties seized by eminent domain are required to reimburse the landowner at the fair market value of the land, but the fair market value does not take into consideration the future loss of income to the farmer or the rancher.

In order to better compensate for the future loss of incomes to farmers and ranchers for properties taken by eminent domain, my bill would require that such properties be reimbursed to the landowners at twice the fair market value of the agricultural land. To be fair, it could be further argued that twice the fair market value does not adequately compensate farmers and ranchers for the long-term loss of their agricultural lands, but raising the rate to twice the fair market value at least gets us closer to what is fair.

In order to help the members of the Judiciary Committee better understand and appreciate the future loss of income to farmers and ranchers when their lands are taken by eminent domain, I showed them areal pictures of a parcel of irrigated agricultural land where the Nebraska Department of Transportation would seize a 100 feet strip along one side. Shortening the pivot by 100 feet would reduce the acreage of farmable land from 121 acres down to 103 acres and realigning the sprinklers would cost several thousands of dollars to retrofit the pivot and the loss of production would amount to experiencing a total crop failure once every 6.6 years.

LB 394 also requires governmental entities to reimburse landowners for the replacement costs of any permanent structures on the land which have to be condemned. A new barn is a huge expense to a landowner which is not currently covered by the law. My bill would require these governmental entities to reimburse landowners for the replacement costs of all dwellings, garages, sheds, barns, wells, septic systems, and fences lost due to the use of eminent domain.

It is interesting to note that paid lobbyists representing several governmental agencies showed up to testify against my bill at the public hearing. Each of these testifiers represented a different governmental agency or entity, but none of them represented the people of Nebraska. I believe I did. Moreover, not one private citizen showed up to testify against the bill. That did not surprise me. The fact of the matter is that our current eminent domain laws favor these governmental entities, but leave our property owners worse off than they were before their lands were ever taken.

Finally, the Nebraska Department of Transportation informed the Judicial Committee in the fiscal note that accompanied the bill that the bill would cost them $7,500,000 annually. So, in my closing remarks I pointed out how this figure proves my point. If the Legislature does not pass LB 394 this year, the cost to Nebraska landowners will be $7,500,000 per year!

February 16th, 2023

Last week we started floor debates in the Nebraska State Legislature, and the first thing on the agenda was to confirm the governor’s appointments. In the past, this process would usually take three to four hours of floor debate to complete. The appointments would be confirmed and the Legislature would then move on to other business, such as debating bills.

That has not been the case this year. A few Democrats have decided to hold up the confirmation process. Consequently, we spent the first four mornings of the week working through a handful of confirmations. Let me remind you that the Unicameral Legislature is supposed to be a non-partisan body, right? Well, there is nothing non-partisan about what these few Senators did last week.

One of the arguments I often hear against switching back to a bicameral legislative system is that it would result in passing bills along partisan lines. What we have in our unicameral legislative system today is partisanship. Under our current system a very small faction of the minority party is able to dominate and control all debates on the floor of the Legislature. You might be wondering, “Why would they do that?” The reason is that several bills will soon be advancing out of committee and move up to the floor for debate on General File. Many of these are bills that those in the minority party do not like, such as LB77, a bill for constitutional carry without a permit, LB 626, the heartbeat bill, and LB 575, the Sports and Spaces Act which restricts biological male students from participating in female sports.

The strategy of these Senators is to waste as much time as possible in order to prevent bills like these from being debated on the floor. It is ridiculous that our unicameral system of government allows for a small minority to hold up the will of the majority. If democracy is supposed to be about the rule of the majority, then our unicameral system is hardly democratic and it certainly is not non-partisan.

One of my bills, LB 101, had a public hearing last week. This is a bill to prevent insurance companies from collecting workers compensation insurance premiums from farmers, ranchers and other small businesses who hire contract labor. Current state law allows for small companies with ten or fewer employees to be exempt from carrying workers compensation insurance, but the law is vague and is not being properly upheld in the courts. So, my bill solves this problem.

Here’s why my bill is needed. A farmer who hires an independent contractor to haul his corn to the elevator, or to build a fence, should not have to carry workers compensation insurance. These folks are not employees of the farmer or the rancher, but the courts are now siding with the insurance companies and are forcing our farmers and ranchers to buy workers compensation insurance in order to cover these kinds of contractors. The insurance companies call this a surcharge; I call it a fine. Some of these so called “surcharges” can amount to several thousand dollars and that is why we need LB 101.

One would think that the agricultural lobbyists would support this kind of legislation. After all, they are supposed to represent farmers and ranchers, right? Well, that is not the case. Farm Bureau, for example, testified against my bill at the hearing. The most troubling part is the fact that not one of these farm groups ever came to my office in advance of the hearing to discuss possible solutions to the problem.

What happens is that lawyers show up at hearings and tell the committee members why a bill is a bad idea. They rarely ever offer solutions to problems. I am patiently waiting for the first time that a lawyer shows up at a hearing and says, “This bill is not the answer, but here is the solution to the problem.”

The lobbyists have no solutions to the problem that LB 101 fixes. It is my opinion that every bill should solve a problem, and that is exactly what LB 101 does. I defined the problem for the committee, and then I offered a solution. My job as a State Senator is to make sure that the members of the Business and Labor Committee who conducted the hearing have the necessary information to make the right decision to solve this very troublesome problem, and that is exactly what I did.

Please feel free to contact my office at (402) 471-2616 or send me an email at serdman@leg.ne.gov.

February 10th, 2023

State agencies are supposed to work for the State of Nebraska. State Senators represent the people of Nebraska because they are elected by the people of Nebraska. So, it is inappropriate for the director of any state agency to tell the Legislature what to do. Instead, it is the job of the Legislature to make the laws, and it is the job of each state agency to carry out those laws. That is, unless you work for the Game and Parks Commission.

Protocol for the director of any state agency is to testify in the neutral position on a bill. The director’s job when testifying on a bill during a public hearing is not to sway the committee’s opinion one way or the other, but to provide the committee with any relevant information they may need to make an informed decision.

Several bills were heard recently in the Unicameral Legislature which involved the Game and Parks Commission. So, when Tim McCoy, the director of the Game and Parks Commission, testified on Sen. Brewer’s bill, LB 456, which reimburses landowners for damages done to property caused by wildlife, and when he testified on my bill, LB 397, to move the headquarters of the Game and Parks Commission to Sidney, he testified in opposition to these bills. It is not the director’s job to tell the Legislature how to do their job.

Sen. Brewer’s bill, LB 456, involves the distribution of money needed to pay for wildlife damages to crops and livestock. The bill has a cost of $9.3 million per year. I have a bill in the Appropriations Committee, LB 744, which takes $10 million from the Game and Parks Wildlife Conservation Fund to pay for these reimbursements so that there would be no extra cost to the State.

Western Nebraska has a lot to gain if the Game and Parks headquarters is moved to Sidney. For example, if only one quarter of the workforce currently employed by the Game and Parks Commission moves to Sidney, it would result in an additional economic advantage of 75 million dollars annually to that city’s economy. Moreover, these kinds of government jobs bring long standing stability to a city’s economy.

There is no good reason for a state agency, such as the Game and Parks Commission, to remain headquartered in the City of Lincoln. The headquarters for a state agency ought to be placed in a location that is relevant for the kind of work that it does. For example, the Oil and Gas Commission is headquartered in Sidney because that is where most of our oil fields are located. Similarly, the Game and Parks Commission should be located in Western Nebraska because that is where the antelope, big horn sheep, elk and mountain lions live.

Because so many state agencies are located in the City of Lincoln, it is fair to say that the City of Lincoln lives off of the tax dollars spent by folks living in the rest of the state. This problem is so bad that when you near the City of Lincoln while driving on I-80 and you roll down your window, you can smell the taxes.

The Game and Parks Commission completed a survey in 2002 in the Pine Ridge area and that report stated that 150 elk were present and living in that area. The report also said that 600 head of elk was the maximum head count that should ever be allowed. Knowing this, one would think that the Game and Parks Commission would continue monitoring the population of elk in order to control their numbers. Well, that was not the case. Today, the Game and Parks Commission does not know how many elk live in Nebraska. Instead, they have partnered with UNL to do another study which won’t be completed until the year 2028! Wow!

Moving the headquarters of the Game and Parks Commission to Sidney would help those who work for the Commission to see and experience what it is like to live where the wildlife roam.

February 3rd, 2023

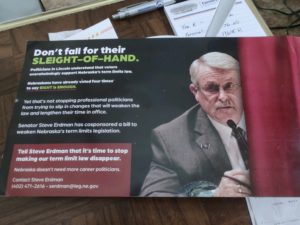

By now many of you have received a postcard or two in the mail indicting me for trying to repeal term limits. Since these postcards went out in the mail, I have received numerous phone calls and emails about term limits. I deeply appreciate the phone calls and the emails I have received. I have been especially blessed by constituents who have sought me out to find out the truth about what this is all about, so today I would like to set the record straight about what the Legislature is trying to do regarding term limits.

The first thing I want you to know is that the postcards you have received in the mail are hit-pieces that are designed to smear my good name without knowing my position on the issue. The postcards accuse several state senators, including me, of committing a “slight of hand” maneuver to get rid of term limits for good. These were mailed out to residents living in 40 of Nebraska’s 49 legislative districts. Each postcard has a picture of the state senator representing that district along with his or her office phone number and email address. 40 legislative districts have been targeted because 40 State Senators co-signed a particular piece of legislation that the Virginia based group, Liberty Initiative, doesn’t like.

There is no “slight of hand” going on. “Slight of hand” suggests that these 40 state senators were trying to do something illegal, immoral or underhanded, and no such thing has occurred. The postcards sent out by the Liberty Initiative insinuate that the Unicameral Legislature somehow has the power to change term limits for state senators, and that simply is not the case. The reason that state senators cannot change their own term limits is because term limits are embedded in the Nebraska State Constitution, Article III, Section 12. Changing the Nebraska State Constitution always requires a vote of the people, and the Liberty Initiative conveniently left out that very important piece of information on their postcards.

So, what did I do? I, along with 39 other state senators, co-signed LR22CA. LR22CA is a resolution for a constitutional amendment to add a third consecutive term to a state senator’s tenure before he or she would become ineligible to run for the office again. LR22CA was introduced by Sen. Robert Dover of Norfolk, and if passed by the Legislature, would put an initiative on the 2024 ballot for the voters to decide. Again, it would be the voters who would decide this matter, not the Unicameral Legislature.

I co-signed LR22CA not because I agree with the bill itself; instead, I agree with a pending amendment to the bill. The pending amendment to LR22CA would limit a state senator to serving only three terms. In other words, three strikes and you’re out…for good. My position is that a state senator should be allowed to serve three consecutive terms and then never be allowed to ever run for the office again.

So, why the need for a third term? It has been the experience of many state senators, including me, that during the first term a state senator learns how to navigate the Unicameral Legislature. Freshman senators rarely ever get the opportunity to serve as committee chairs. During a second term, a state senator may get the opportunity to serve as a committee chair, but it often takes that senator four years to learn how to run the committee with excellence. A third term would allow a state senator who is a committee chair to run a committee with the kind of knowledge and skill that can only be acquired through legislative experience.

The State of Nebraska is a multi-billion-dollar operation. State senators are charged with the tasks of shaping tax policy, appropriating revenues, regulating banks, businesses and insurance companies, and legislating policies for recreation, conservation, natural resources, agriculture, healthcare, corrections, and several other facets of government which are too numerous to list here. Institutional knowledge becomes vitally important in a Unicameral Legislature where there is a high rate of turnover and where lobbyists and special interest groups are constantly trying to influence legislation.

January 27th, 2023

It’s hearing season at the State Capitol! Every bill that gets introduced in the Unicameral Legislature gets a public hearing. Hearings for certain committees will last through the month of March. Last week the Legislature held hearings on four of my bills, so today I would like to tell you about the hearings on those bills.

The first of my bills to have a public hearing was LB 28, a bill designed to save taxpayers from paying too much in property taxes whenever the Tax Equalization and Review Commission (TERC) takes too much time to decide a case. My bill would allow the property to remain at the previous year’s value for tax purposes until the TERC board makes a decision on the case. I believe this is a common-sense solution which favors the taxpayer over those who impose the taxes.

The second bill which had a hearing last week was LB 102, a bill to help land surveyors do their job more efficiently. While the bill updated the plane coordinate system used by land surveyors and recognizes those who do the work as professional land surveyors, the main thrust of the bill is that it allows them to enter land to do their work. Because many landowners live out of state and the work of land surveying often requires them to enter several properties, my bill will make their work much more efficient while continuing to hold them accountable for any damages done to property and crops.

The third bill which received a hearing was LB 395, a bill to increase the pay of the members of the Oil and Gas Commission. This bill is necessary. Currently, the pay rate for the Oil and Gas commissioners is set in statute at $400 per meeting and capped at $4,000 for the year. Because the commissioners often meet more than once per month, my bill raises their rate of pay to $500 per meeting and removes the cap. It will also adjust their pay on odd numbered years going forward according to the Consumer Price Index for Urban Wage Earners and Clerical Workers so that the commissioners don’t have to wait another 70 years for the Legislature to act.

The last bill of mine to receive a hearing last week was LB 29, my damaged property bill. In 2019 I introduced a destroyed property bill which passed into law and saved many landowners from the floods that occurred that same year. However, the bill was too restrictive. So, when the protestors of 2020 burned down an insurance building in Lincoln, the landowners were denied a reduction in their property taxes because arson did not fit the criteria of a property destroyed by a natural disaster. By changing the word ‘destroyed’ to the word ‘damaged’ and removing the language about calamities and natural disasters, the law would allow for cases of arson to qualify.

All of my bills that received a hearing last week are common-sense bills which ought to pass into law this year. Each of these bills received either no testimony in opposition or minimal testimony in opposition. Therefore, I am hopeful that all four of these bills will pass into law later this year.

Sen. Steve Erdman

P.O. Box 94604

Lincoln, NE 68509

(402) 471-2616

Email: serdman@leg.ne.gov

- Column (376)

- District Info (8)

- Events (6)

- Opinion (2)

- Press Releases (13)

- Uncategorized (4)

- Welcome (1)

You are currently browsing the archives for the Column category.

-

Appropriations

Committee On Committees

Rules

Building Maintenance

Streaming video provided by Nebraska Public Media