NEBRASKA LEGISLATURE

The official site of the Nebraska Unicameral Legislature

Sen. Steve Erdman

District 47

The content of these pages is developed and maintained by, and is the sole responsibility of, the individual senator's office and may not reflect the views of the Nebraska Legislature. Questions and comments about the content should be directed to the senator's office at serdman@leg.ne.gov

November 2nd, 2018

I begin this week by tipping my hat to Wolf Auto of Ogallala because of the many ways they have modeled volunteerism and community service this year. Wolf Auto was recently nominated for a Step Forward award by Serve Nebraska because of their excellent example in community service. Wolf Auto raised money for the Ogallala High School, the Relay for Life, the Backpack program, CASA, SCIP, Royal Camp, and the Rotary Club, as well as over 50K for five families who lost everything in the Lake McConaughy fire. They volunteered at the Car Seat Check-ups and at concerts, and they also sponsored drives for diapers, school supplies, clothing, and furniture. They even raised money for the Ogallala community by organizing their own car washes, garage sales, and silent auctions.

I would also like to thank all of the volunteers who make our lives easier and who make our communities better places to live. Among these are all of the volunteer firemen, first responders and others, who both protect and serve our communities. I would also like to thank the many other businesses in Western Nebraska who make significant contributions to our communities and who also deserve recognition for their charity work.

Now that the campaign season is finally over, we enter into a different kind of season, namely the season of giving. For many people November begins the season of charity work. While volunteerism ought to occur all year long, the holidays present us with some very unique opportunities for sharing both our time as well as our treasure. Therefore, before we enter into the holiday season I would like to encourage everyone living in Western Nebraska to seek out some way of giving back to their community this year.

One of the charity organizations I hold in high esteem for their beliefs, values, and integrity as well as for the work they do in the community is the Salvation Army. The Salvation Army was established in London back in 1865, but it has been operating in the USA since 1883. More than 23 million Americans receive assistance from the Salvation Army every year. Their services include food for the hungry, relief for disaster survivors, assistance for the disabled, outreach to the elderly and the ill, clothing and shelter for the homeless, and help for underprivileged children.

Please consider volunteering your time to the Salvation Army. Each year 25,000 volunteers across the country ring bells, solicit donations, and tend to thousands of red kettles for the Salvation Army. In Western Nebraska the Salvation Army has bell ringing programs in Alliance, Chadron, Holdrege, McCook, and Scottsbluff. To learn more about the Red Kettle Campaign or to register as a volunteer, please visit www.ringbells.org.

Let us brighten the holiday season this year for as many people as possible by remembering and acting upon the words of our Lord Jesus Christ as recorded in Acts 20:35, “It is more blessed to give than to receive.”

October 25th, 2018

People occasionally ask me what I do as a Nebraska State Senator when the Legislature is out of session. Well, there is a lot more to being a Nebraska State Senator than simply debating bills on the floor of the Legislature, holding public hearings, and voting. So, today I would like to introduce you to some of the off season duties of being a Nebraska State Senator.

Bills are always written when the Legislature is out of session. All bills must be introduced during the first ten days of the legislative session, so there is no time for writing bills during the session. I like to begin the bill writing process by first listening to my constituents, not the lobbyists, so that I introduce the kind of legislation folks in the Panhandle care about most. Once I decide on an idea, though, that is when the real grunt work of study and research begins. This year I have devoted a lot of my time to researching agricultural land valuation reform. Once again, my bill will change agricultural land valuations from the current market based system to a productivity system, making the process much more fair and equitable.

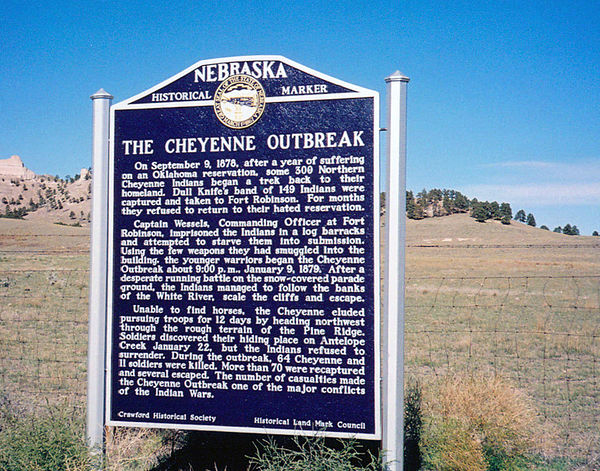

As a Nebraska State Senator I represent the district even when the Legislature is not in session. So, I occasionally get called upon to give speeches, present awards, and give interviews. Earlier this month, for example, I delivered a speech at the dedication of the new historical marker commemorating the crossing of the Northern Cheyenne over the South Platte River. While these kinds of activities certainly represent the lighter side of being a Nebraska State Senator, they are not the most rewarding thing I do during the off season.

The most rewarding thing I do during the off season is helping people. For instance, as a Nebraska State Senator, I have had the privilege of helping several Medicaid patients get the services and care they need, which can be a difficult task for someone who is sick or disabled. Speaking of the disabled, because one concerned disabled constituent notified me about the condition of the restrooms at the Bridgeport State Recreation Area, the Game & Parks department will soon be making them compliant with the Americans for Disabilities Act.

I recently had the privilege of helping a trucker get his birth certificate so that he could renew his license. He needed it right way; otherwise, he would not be able to work. Because the State’s Vital Records department had been reduced down to only one employee the process of obtaining birth certificates had slowed to a crawl. Working with DHHS, we were able to get him pushed up to the front of the line, so that he could go back to work.

I have also had the privilege of helping several Nebraskans living in the Panhandle resolve some of their difficult issues with the Department of Transportation. These problems have ranged from placing signage on private property along scenic highways, to providing driveways for residential and truck traffic, and even building an exit ramp to access a gas station when road construction was being done on I-80. Working with the Department of Transportation, we were also able re-open the railroad crossing at Lodgepole after it had been closed for 30 days, and we’ve been able to keep the Duel County Minibus up and running.

These are just some of the different ways I have been able to help the constituents of district 47. However, I know that the constituents of district 47 need property tax relief more than anything else. Therefore, over the summer I met with Nebraska Taxpayers for Freedom to inaugurate a new citizen led petition drive to put a property tax relief initiative on the 2020 ballot. This ballot initiative is a constitutional amendment which will allow each property owner to claim a 35% property tax credit or refund on their Nebraska State income tax return. I will also introduce a similar resolution in the Legislature in January.

Thank you for allowing me to serve as your State Senator. I will continue to serve the people of district 47 by looking for even more common sense ways to turn the good life into the great life.

Finally, don’t forget to vote on November 6!

October 22nd, 2018

The behavior of extremist, left-wing professors is worsening at the University of Nebraska. Their behavior has grown much more bold and brazen, and today I would like to share some examples with you of how all civility has now been lost in the University of Nebraska System.

First, a mutiny led by extremist, left-wing professors has led to the overthrowing of the president of the University of Nebraska Faculty Senate. For the first time since its creation in 1974, the president of the Faculty Senate has been removed from office. President Jeffrey Rudy was voted out of office on Oct. 2.

So, what exactly did Rudy do? After Marco Abel and Julia Schleck received the James A. Lake Academic Freedom Award for defending the English Department against political attacks, Rudy spoke out against the decision and was accused of making “accusatory and defamatory judgments” about other members of the Faculty Senate. Rudy defended Kaitlyn Mullen by criticizing how extremist, left-wing professors bullied her as she tabled for Turning Point USA last year. And, for making these kinds of accusatory statements his academic freedom was overruled by the other members of the Faculty Senate.

Rudy was also accused of making “unilateral decisions without consultation.” After the AAUP censured the University of Nebraska for firing Courtney Lawton, the graduate teaching assistant who bullied and berated Mullen and called her a “Becky”, Rudy dared to form a committee to get the University removed from the AAUP’s censure list without consulting the extremist opinions of these same left-wing professors. And for that, he was dethroned.

Second, Andy Park and Ron Himes, two extremist, left-wing professors at the Johnny Carson School of Theatre & Film, have made it a point to deliberately insult Christian conservatives on campus. The Nebraska Repertory Theater recently performed, “An Act of God,” a play full of religious bigotry. While billed as a “History Maker,” the play is really nothing more than a sacrilegious attempt to mock God and those who believe in Him. The play is partially funded with Nebraska tax dollars and is performed in very poor and obscene taste. For instance, there is nothing funny about God creating Florida in the shape of male genitalia or God associating his Son with female genitalia, yet these statements describe actual lines from the play. The play is highly irreverent, but don’t take it from me; take it from the producers of the play, who advertised the play on their own website as being “irreverent.” Moreover, Jesse Green, writing for Vulture, a secular online theater magazine, described the play as “…one of the most vehement takedowns of the deity ever to reach Broadway.” The play was neither art nor comedy; it was offensive atheistic propaganda and mockery designed to offend religious students on campus.

Third, certain extremist, left-wing professors have begun asking students in class about their religious and political biases. When one student answered that he had no biases, the professor hounded him until he admitted that he had “a bias against liberal Democrats.” In order to punish or deprogram the student, he was assigned the task of following a liberal Democrat State Senator around the Capitol for several days; thus, violating the non-partisan spirit of the Unicameral.

Fourth, certain extremist, left-wing professors at the University of Nebraska continue to harass Kaitlyn Mullen more than a year after her incident of tabling for Turning Point USA. Chemistry Professor, Gerard Harbison, for example, continuously trolls Mullen online, leaving creepy and negative messages on her social media pages. Harbison trolls Mullen under the online alias, “Moloch’s bartender,” which is an obvious reference to the ancient Canaanite god known for child sacrifice. To be sure, Mullen’s death is exactly what he wants. For instance, in one post he referred to Mullen as a “junior Nazi di—– who will soon be underground.” So, Harbison made a death threat against Mullen, and yet nothing has ever been done to confront him or to reign in this kind of behavior, yet it has been going on for over a year.

As you can see, the University of Nebraska System has now devolved into the kind of place where freedom of speech means only that faculty members can do whatever they want, including harassing students, offending them, and even threatening their lives without any fear of consequence, and, those faculty members who dare to speak out against what these extremist, left-wing professors are doing are quickly purged from all positions of leadership.

Gerard Harbison

October 12th, 2018

Initiative 427 will appear on your ballot as the latest attempt to expand Medicaid coverage under Obamacare. Medicaid expansion has unsuccessfully come before the Unicameral numerous times, and the pros and cons your Nebraska senators have considered in previous years are relevant to Initiative 427. Like most issues, Medicaid expansion is not black and white. As your representatives in the Nebraska Unicameral, we feel obligated to share our concerns and urge you to consider the consequences Medicaid expansion would have on our state.

Expanding Medicaid through Initiative 427 would hurt our most vulnerable Nebraskans by removing the focus of Medicaid benefits from people with disabilities, children, and pregnant women and placing the focus on working-age adults without disabilities or children. The costs of expansion would make property tax relief nearly impossible, leave the state’s reserve funds at a dangerously low level, and put funding at risk for K-12 education, the University of Nebraska, roads, and current Medicaid recipients.

Obamacare (the Affordable Care Act) requires the federal government to reimburse states for only a portion of Medicaid expansion costs. Initiative 427 would require the state to fund the remaining expansion expenses – a price tag projected to cost Nebraska taxpayers $33 million in 2019-20 and up to $768 million over the next decade according to Nebraska’s Legislative Fiscal Office and Department of Health and Human Services. Actual costs have far exceeded projections in nearly every state that has opted to expand Medicaid under Obamacare. For example, in the first year Iowa expanded Medicaid, actual costs totaled nearly $150 million more than expected.

In a study published this month, Nebraska was ranked number one nationally for financial wellbeing. We have accomplished this by using taxpayer dollars cautiously and keeping unpredictable financial obligations out of our state budget. Unlike Washington, we balance our state budget each year and remain debt free. Medicaid expansion would create an unpredictable financial obligation on Nebraska, as seen in other states, which could throw our balanced budget into jeopardy. If Initiative 427 passes, Nebraskans could be forced to choose between increasing taxes or cutting funds to existing programs, such as K-12 education, roads, or current Medicaid benefits. Tax increases would create an overwhelming financial hardship for most Nebraskans, and cutting funds to existing programs is an equally unappealing option.

As Nebraskans, we have always prided ourselves in looking out for our friends and neighbors who are in need. Our current Medicaid program provides health care benefits to people with disabilities, children, and pregnant women. We are one of the few states to offer all federally optional Medicaid services (such as prescription drugs, mental health services, and care for the developmentally disabled) in addition to federally required services. Although the federal government would fund a limited portion of Medicaid expansion, none of these funds can be used to support benefits for current Medicaid recipients. As a result, some states have been forced to cut optional Medicaid services to their most vulnerable citizens – a reality Nebraska would also likely face.

Current Nebraska Medicaid recipients are at risk of losing benefits for dental services, prescription drugs, treatment for specific diseases (such as breast and cervical cancer), vision care, mental health, speech and occupational therapy, and many more. Initiative 427 would put the needs of working-age adults without disabilities over the needs of our friends and neighbors with disabilities, children, and pregnant women who truly cannot afford to lose these essential services Nebraska provides.

Medicaid expansion would place a significant burden on Nebraska taxpayers that could hurt Nebraska’s most vulnerable citizens. Before you cast your vote on Initiative 427, we urge you to consider the impacts Medicaid expansion would have on your neighbors, your family, your business, and your budget.

Senator Joni Albrecht; District 17 – Chair, Business & Labor Committee

Senator Lydia Brasch; District 16 – Chair, Agriculture Committee

Senator Curt Friesen; District 34 – Chair, Transportation & Telecommunications Committee

Speaker Jim Scheer; District 19 – Speaker of the Legislature

Senator Bruce Bostelman; District 23

Senator Tom Brewer; District 43

Senator Rob Clements; District 2

Senator Steve Erdman; District 47

Senator Steve Halloran; District 33

Senator Lou Ann Linehan; District 39

Senator John Lowe; District 37

October 5th, 2018

The State of Nebraska is quickly going broke. Many State legislators have been spending money faster than revenue has been flowing, or should I say ‘trickling’, into the State’s coffers, and if we don’t do something about it soon the State will soon go broke. Nebraska has a spending problem and today I am going to show you why.

The State of Nebraska has been living off of its cash reserves, and those cash reserves are starting to dry up. Back in 2016 we had more than $680.6 million sitting in our cash reserves. But that situation began to change the very next year. In Fiscal Year 2017-2018 our estimated cash reserves were projected to fall to $562.5 million. Then, the cash reserves for Fiscal Year 2018-2019 were originally projected to be only $379.5 million; however, when the Revised Biennial Budget came out in May of this year the readjusted projections for our estimated cash reserves pushed them down to $296.4 million. Needless to say, the State is going broke.

In 2017 I advised the State Legislature to make $250 million in spending cuts from the State’s Biennial Budget. The loss of revenue from the State’s coffers turned out to be $223 million. So, my projection was very close to what actually came in. Had we made those spending cuts, we would not be in the dire situation we are in today.

The State of Nebraska has less money in its cash reserves than the University of Nebraska has in theirs. In order to maintain its AAA credit rating, the University of Nebraska maintains at least $330 million in its cash reserves. As you can see, that is more than we have in our State’s cash reserves. Consequently, we can no longer afford to continue funding an institution with a never ending appetite for more State money.

As I indicated last week, if the voters pass Medicaid expansion in November, the Appropriations Committee will have to somehow come up with an additional $45-$90 million to pay for it, and they will have to do this on top of solving our State’s current revenue problems. What this will mean for the voters is more money out of your pockets. State legislators will either have to make enormous cuts in the State’s Biennial Budget or open up new streams of revenue for the State, or do both.

Finally, Nebraska needs to fix its prison system, and it will likely cost the State millions of dollars to do it. Nebraska’s prisons are overcrowded, understaffed, and underfunded. Back in April the State lost a labor ruling, forcing it to bring an end to its 12 hour work shifts. This means that our corrections facilities need to hire more workers, and that means even more money.

As you can see, with the trickling of our revenue sources, Nebraska is going broke. Once we go into the new Legislative Session in January, I will create a special file for those bills which come in with a positive fiscal note attached, and I will label that new file as “The Trash Can.”

On another note, I would like to encourage everyone living in Nebraska to register to vote. You may register in person or by mail. If you choose to register in person, you may do so at the Department of Motor Vehicles. If you choose to register by mail, you may download the application online by going to: https://www.dmv.org/ne-nebraska/voter-registration.php. If you register by mail, the envelope must be postmarked by October 19.

How do you know if you are eligible to vote? You may register to vote in Nebraska if you are a United States citizen, if you will turn 18 years old on or before Election Day, and if you reside in Nebraska. You are ineligible to vote if you have been declared mentally incompetent or are a convicted felon and it has been less than two years since you were discharged from supervised release.

September 28th, 2018

One of the items that will appear on your ballot next month is a measure for Medicaid expansion. This ballot measure is the result of a successful citizen led initiative by Insure the Good Life, which collected more than 104,000 signatures for its petition drive. So, the time has come for us to ask: Is Medicaid expansion really good for Nebraska? Medicaid expansion won’t be good for Nebraska and today I would like to explain why that is the case.

The Medicaid expansion measure on your ballot would extend coverage out to those living at 138 percent of the federal poverty level, which amounts to an estimated 90,000 Nebraskans. While this sounds quite nice and compassionate, it would actually have the opposite effect on our State’s poorest citizens. Allow me to explain.

Under our current system with the Obamacare Marketplace those living at 138 percent of the federal poverty rate qualify for free healthcare plans or healthcare plans with $0 premiums. These are private healthcare plans which provide easy access to doctors, hospitals, healthcare clinics, and pharmacies. However, Medicaid expansion would force these same individuals into Heritage Health, which is our State’s Medicaid program. Under Heritage Health doctors, hospitals, healthcare clinics, and pharmacies become difficult to find. For instance, some of our Medicaid patients under Heritage Health have had to drive to Lincoln or Omaha just to find the services they need.

After an additional 90,000 patients get added into Heritage Health, benefits would necessarily be reduced for everyone in the Medicaid system. The reason is that Nebraska has no way to pay for the extra costs associated with Medicaid expansion. In order to keep benefits at their current levels, the Nebraska State Legislature would be forced to either raise taxes or to make huge cuts in its biennial budget or both. You might as well kiss any hopes of ever getting property tax relief good-bye!

Medicaid expansion always turns out to be more expensive than originally projected. The original cost for Medicaid expansion in Nebraska was projected to be $45 million per year, but that cost is more realistically projected to be $90 million. States that implement Medicaid expansion always find out that it is more expensive than originally forecasted. For example, in Iowa the per-member Medicaid costs have nearly tripled. Last year, for instance, Iowa’s per member cost rose 4.4 percent compared to the 1.5 percent for the previous six years. Iowa’s Medicaid expansion bill went into effect in 2015.

Medicaid expansion is unsustainable. While individual states provide 10 percent of the funding, the federal government is expected to provide the other 90 percent. Because our national debt already exceeds $21.5 trillion, it is safe to say that the federal government cannot afford to pay for Nebraska’s Medicaid expansion. For this reason, Governor Ricketts has expressed doubt that the federal government would be able to pay their portion of the costs. In fact, there is nothing preventing the federal government from shirking its responsibility to our State.

The success of a social welfare program like Medicaid should never be measured by how many people we can put onto it, but by how many people we can get off of it. For this reason, Louisiana Congressman Steve Scalise recently said, “…Medicaid is one of the most failed forms of healthcare,” and Ronald Reagan said during his 1980 presidential campaign, “I happen to believe that the best social program is a job.”

September 24th, 2018

Should the University of Nebraska hire a Vice Chancellor of Diversity and Inclusion? Today I would like to show you why this is a huge mistake.

Hiring a Vice Chancellor of Diversity and Inclusion won’t diversify the faculty. The only study ever completed on this subject was submitted in August to the National Bureau of Economic Research. After looking at 462 research institutions in the United States, James West along with his team of researchers concluded that they “were unable to find any statistically significant increase in faculty diversity after the creation of a chief-diversity-officer position.” So, Hank Bounds, Ronnie Green and the 17 member search committee are only fooling themselves into believing that hiring a Vice Chancellor of Diversity and Inclusion will somehow diversify the faculty at the University of Nebraska.

Hiring a Vice Chancellor of Diversity and Inclusion is too expensive. The salary for a Vice Chancellor of Diversity and Inclusion would most certainly be in the six-figure salary range. For instance, James Moore III, who is the Vice Provost of Diversity and Inclusion at Ohio State University draws an annual salary of $197,272. Moreover, Donnie Perkins, who works as the Diversity Dean for Ohio State’s College of Engineering makes $265,044 per year. As you can see, the six-figure salary alone makes this a bad choice for Nebraska.

The cost of hiring a Vice Chancellor of Diversity and Inclusion runs much deeper than simply paying for his or her salary. The fact of the matter is that a Vice Chancellor of Diversity and Inclusion will want to hire a staff. The Diversity office at Ohio State University has a staff of 88 employees with an annual payroll of $7.3 million. The Diversity office at the University of Michigan employs 100 staffers for an annual payroll of $11 million. So, the cost of hiring a Vice Chancellor of Diversity and Inclusion would likely cost the University of Nebraska millions of dollars in the end.

Contrary to the opinion of UNL’s administrators, diversity and inclusion programs never result in treating all students the same. The cold, harsh reality of all diversity and inclusion programs is that they attempt to prevent discrimination against certain groups by discriminating against other groups. The fundamental mistake in the diversity and inclusion worldview comes in the way they value results over opportunities. Diversity and Inclusion officers are always charged with the task of helping disadvantaged students succeed in college, but this practice only discriminates against those who are perceived or misperceived as having some kind of advantage. To the contrary, I believe the only way to make things truly fair at the University is to treat everyone with dignity and respect and to offer all students the same opportunities without guaranteeing them or offering them the false hope of results.

Whenever students are guaranteed the same results, instead of the same opportunities, the incentive to achieve is lost. It is no different than the Pee Wee League which provides trophies for everyone who participates; participants quickly learn that there is no need to practice, to study, or to try hard when the gift of a trophy or a college degree is always waiting for them in the end.

Diversity and inclusion undermines real academic freedom. While the proponents of diversity and inclusion view themselves as the torchbearers for tolerance, tolerance for opposing viewpoints is never what they really care about. Instead, they become walking contradictions. In order to help you see this, consider how NU President, Hank Bounds, responded to my first article against the hiring of a Vice Chancellor of Diversity and Inclusion. Bounds said in a written statement: “…I’ve seen again and again that we are stronger when we serve alongside people who don’t look or think like us,” but, then he went on to contradict himself by expressing his intolerance for my point of view: “For any elected official to champion these kinds of dangerous views only serves to damage our great state…” Bounds cannot have it both ways: Either he tolerates differing points of view or he does not! Bounds and Green do not really care about diversity. If Bounds and Green really cared about diversity, they would begin by diversifying the English Department!

Dr. James L Moore III, Vice Provost of Diversity & Inclusion at Ohio State University

September 14th, 2018

My number one goal in the State Legislature is to reduce your property taxes. Property taxes are out of control and have put our State on a trajectory that it can no longer sustain. Consequently, the Governor, state lawmakers, lobbyists, and concerned citizens have all begun looking at new ways for the State to generate more money for the Government to spend.

My experience in the State Legislature has taught me one very important rule: Whenever there is money in the State’s coffers to be had, there is a long line of politicians, lobbyists, and even concerned citizens waiting to spend it, and they all believe they know how best to spend it.

Last week a public opinion poll was released by the Holland Children’s Institute (HCI) showing that nearly 6 in 10 Nebraskans believe state lawmakers should “find new revenue streams to balance the state budget and bolster support for mental health programs, K-12 public education and infrastructure.” The grocery list of other goodies Nebraskans said they would like to see state lawmakers pay for include early childhood education, job training programs, Medicaid expansion, employment benefits, and higher education. Where is Santa Claus when you really need him?

To be sure, there are several ways the State can generate new sources of revenue. Some of these new revenue streams include the collection of online sales taxes, and the elimination of sales tax exemptions. But, keep this one fact in mind: Each of these new revenue streams is really nothing more than a new way for the government to reach deeper into your pockets in order to take more of your hard-earned money.

Of course, there are also the old ways of generating more revenue for the State. According to HCI’s survey, 60 percent of Nebraskans believe State lawmakers should raise taxes on corporations and 54 percent believe the State should raise taxes on our wealthiest citizens.

But, raising taxes is seldom ever a good idea. Raising taxes is the way of Socialism. Socialism kills competition, the incentive to work hard, and the desire to generate wealth. For instance, raising taxes only motivates corporations and wealthy citizens to move to other states where taxes are lower. As Winston Churchill said: “The main vice of capitalism is the uneven distribution of prosperity. The main vice of Socialism is the even distribution of misery.”

Nebraska does not have a revenue problem; we have a spending problem. Nebraska has plenty of money in its coffers. The problem is that we waste money on programs which are either too fat or should be eliminated altogether. Allow me to illustrate.

Nebraska has too many State Government employees. Nebraska currently has 290 full-time State Government employees per every 10,000 residents in the state. By way of comparison, the U.S. average is 243 State Government employees per every 10,000 residents. Iowa has twice the population of Nebraska, yet it operates with a ratio of only 235 employees to every 10,000 residents. If Nebraska used Iowa’s ratio, we could save the State $500,000,000 annually. South Dakota’s ratio is 226 employees to every 10,000 residents. Using South Dakota’s ratio, we could save the State $680,000,000.

Nebraska continues to fund failed programs which ought to be eliminated. A perfect example of this is the Learning Community. In 2016 Gov. Ricketts signed LB1067, which added another 13.4 million in State funding to the Learning Community beginning in the 2017-2018 school year. But, study after study has shown that the vast majority of children catch up academically to their peers by the third grade. So, the State keeps throwing money at a program which has no proven track record of success.

As you can see, Nebraska does not really have a revenue problem at all; we have a spending problem. State lawmakers have not been dealing responsibly with your tax dollars, and this explains why Nebraska continues to be the second most highly taxed state in the Union. Only the state of Illinois taxes their people more than we do!

September 10th, 2018

Nebraskans desperately need property tax relief. Over the past ten years property valuations on agricultural land have increased 252 percent statewide and taxes have increased 162 percent. Meanwhile, valuations on residential properties have increased 40-50 percent. The State of Nebraska currently ranks as the seventh worst state in the nation for property taxes. But, as bad as these state rankings seem, they do not accurately reflect the kind of desperation that so many Nebraskans feel once their property tax bill becomes due. The fact of the matter is that our State is on a trajectory which it can no longer sustain.

Last year my bill (LB829) was criticized because I offered no way to pay for the $1.2 billion in property tax relief mandated by the bill. In response to this, let me assert that any property tax relief bill which proposes a way to “pay for it” without making cuts in the State’s budget amounts to nothing more than a tax shift. What these critics fear more than anything else is making cuts to the State’s biennial budget. Moreover, any bill which identifies a way to “pay for it” by making specific budgetary cuts automatically picks a fight with that particular group, and nothing scares these critics more than a fight.

The fact of the matter is that State legislators will never make any significant budgetary cuts until they are forced to do so. Cutting any budgetary item amounts to political suicide for these kinds of weak politicians. Therefore, the only way to get the kind of property tax relief we need is to mandate property tax relief and force the Legislature to decide later where to make the necessary budget cuts.

To help you see this, consider what the Legislature did in 2016 to the property tax cash credit fund. The property tax cash credit fund was established in 2007 as a way to divert revenue from the State’s General Fund towards property tax relief. LB958 was passed in 2016 and shifted $20 million more from the General Fund to the property tax cash credit fund, increasing the State’s contribution to $224 million. But, when State revenues fell short that year, the Legislature decided to make property owners pay for it. Despite the mandate of LB958 to increase the State’s contribution to $224 million, they only increased it to $221 million. Instead of cutting other budgetary items to pay for the mandate of LB958, State legislators found it easier to transfer the burden onto the taxpayer by cutting their relief.

Politicians without backbone will continue to stand in the way of giving you the property tax relief you need. For instance, Governor Ricketts has refused to endorse any bill providing taxpayers with substantive property tax relief, and Bob Krist never introduced a bill for property tax relief during his nine year tenure in the Nebraska Legislature. Last year Sen. Jim Smith of Papillion, who served as chairman of the Revenue Committee, along with the other members of the Revenue Committee, refused to advance my property tax relief bill (LB829) out of committee, and Reform for Nebraska’s Future, led by former Lincoln City Councilman, Trent Fellers, suddenly ended the petition drive to put the same measure on the November ballot. These kinds of politicians only validate Benjamin Franklin’s old adage that, “…in this world nothing can be said to be certain, except death and taxes.”

But there is hope for the future. In January I will introduce a Constitutional Amendment to permit property owners to get a 35 percent credit or refund of their property tax bill when they go to file their State income taxes. The Revenue Committee will have a new chair next year, so there is a ray of hope of passing this through the Legislature. I am also pleased to announce that Nebraska Taxpayers for Freedom has begun a new petition drive to put this same Constitutional Amendment on the ballot for the 2020 election. Please be assured and know that property tax relief remains my highest priority in the Nebraska State Legislature.

August 31st, 2018

Our national motto has come under attack. Last month the Eighth Circuit Court of Appeals upheld a lower court’s ruling from last December, which ruled that the practice of putting “In God We Trust” on our nation’s coinage and currency violates neither a person’s freedom of speech nor their religious rights.

Atheistic groups, led by attorney Michael Newdow, have been relentlessly challenging public displays of our national motto and consistently losing their battles in court. Their fear that our national motto might somehow give rise to a state religion is simply unfounded. As Diana Verm, of the non-profit law firm Becket, said after the Eighth Circuit Court’s ruling, “The good news is you no longer have to be afraid that the pennies in your pocket are gateway drugs to theocracy.”

As in this most recent court case, New Doe Child #1 v. The Congress of the United States, the courts have consistently ruled that displaying the national motto does not violate the Establishment Clause of the First Amendment of the U.S. Constitution. In other words, displaying the national motto does not establish Christianity or any other religion as the country’s state religion.

The mere threat of a lawsuit is often enough to intimidate and deter school administrators and school boards from displaying the national motto in our public schools. They reason that displaying the motto simply isn’t worth risking a lawsuit which could potentially cost the school district thousands of dollars. Consequently, our public schools now need some help from state lawmakers.

Florida is the most recent state to afford protection to its public schools for displaying the national motto. Florida’s Governor, Rick Scott, signed a bill in March mandating that all buildings used by Florida’s public schools display the motto in a conspicuous place. Moreover, similar bills have been passed in Arkansas, South Carolina, and Tennessee, and in July the Scottsbluff County Board of Commissioners approved a resolution to display a sign with the national motto at the County Administration Building. Therefore, I believe the time has come for the State of Nebraska to take a similar stand in regards to protecting our national motto.

In January I will introduce a bill mandating that our national motto be displayed in a conspicuous place in all of our state’s public schools. In order to further protect our public schools, my bill will require the State’s Attorney General to intervene on behalf of any school, school administrator, teacher, or school board member in the event of a lawsuit. Moreover, my bill will also allow school boards to accept donations to defray the costs associated with displaying the motto. School administrators and school boards will have freedom to choose how they wish to display the national motto, provided that it is written legibly in English and displayed in a location where students will be able see it and to read it on a daily basis.

Sen. Steve Erdman

P.O. Box 94604

Lincoln, NE 68509

(402) 471-2616

Email: serdman@leg.ne.gov

- Column (372)

- District Info (8)

- Events (6)

- Opinion (2)

- Press Releases (13)

- Uncategorized (4)

- Welcome (1)

-

Appropriations

Committee On Committees

Rules

Building Maintenance

Streaming video provided by Nebraska Public Media